Artificial intelligence (AI) has emerged as a pivotal force in the success of stocks, and International Business Machines (NYSE: IBM) has been a pioneer in this arena, long before many of today’s tech companies even existed. With AI at the forefront, IBM’s stock surged to a 52-week high of $197 in January, marking its highest share price in a decade. However, after this peak, the stock price has receded, prompting investors to contemplate whether now is the opportune time to invest in IBM.

The Evolution of AI in IBM’s Revenue Growth

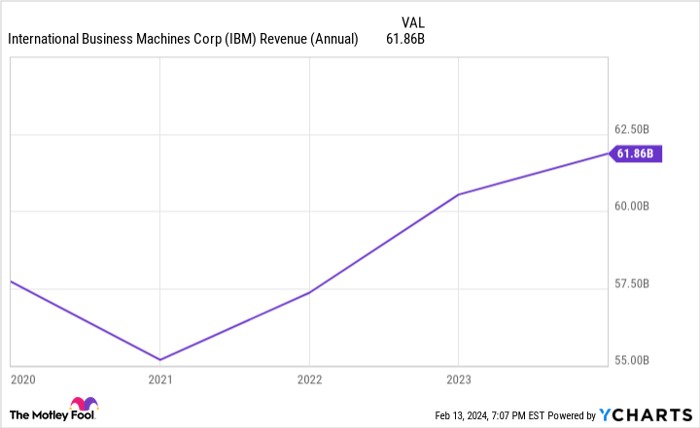

Despite IBM’s extensive history with AI, the company did not wholeheartedly embrace this technology until Arvind Krishna assumed the role of CEO in 2020. The firm’s newfound focus on AI bore fruit in 2023, as IBM concluded the fourth quarter with a 4% year-over-year revenue increase, amounting to $17.4 billion. This robust financial performance contributed to IBM’s total annual revenue of $61.9 billion, indicative of a sustained upward trajectory in revenue over the past few years.

Data by YCharts.

IBM’s consulting division played a pivotal role in driving sales growth, setting it apart from its competitors. Krishnan emphasized, “We are the only provider today that offers both a technology stack… and consulting services for deploying and managing generative AI.”

IBM’s Diverse Areas of Success

While AI has been instrumental in IBM’s revenue growth, the company’s Red Hat cloud computing division and infrastructure segment have also yielded remarkable results. In Q4, the Red Hat division witnessed an impressive 8% year-over-year revenue surge, coupled with a notable 17% increase in annual bookings. On the other hand, IBM’s infrastructure division, specializing in hardware such as computer servers, experienced a 2.7% year-over-year sales uplift for Q4, with the z16 mainframe server outperforming its predecessors. IBM’s 2023 free cash flow (FCF) exhibited a substantial increase to $11.2 billion from $9.3 billion the previous year, reinforcing the company’s capacity to sustain its dividend, currently yielding over 3%. Moreover, IBM expects its FCF to further rise to approximately $12 billion in 2024.

Is IBM Stock Worth Investing In?

IBM is thriving across its business segments, with its robust revenue growth and strong FCF generation indicating its potential for long-term investment. Furthermore, IBM stands to benefit from the escalating growth of the AI market, projected to reach $305.9 billion in 2024 and surge to $738.8 billion by 2030. This trajectory positions IBM favorably for sustained success. While the stock price may be near its 52-week high, adopting a prudent approach such as dollar-cost averaging to acquire shares over time can be judicious, particularly considering the accompanying dividend payments.

Before jumping into investing in International Business Machines, it’s worth noting the insights from the Motley Fool Stock Advisor analyst team, which recently identified what they consider the 10 best stocks for investors to buy now. International Business Machines wasn’t one of them. The 10 stocks that made the cut are envisioned to yield substantial returns in the ensuing years. The Stock Advisor service has significantly surpassed the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Robert Izquierdo has positions in International Business Machines. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.