IBM Readies for Q3 2024 Earnings Report Amidst Competitive Cloud Landscape

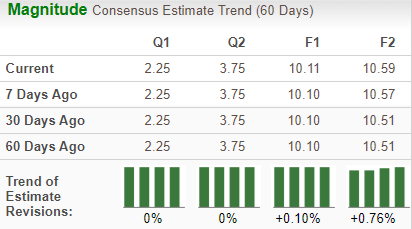

International Business Machines Corporation (IBM) is set to unveil its third-quarter 2024 earnings on October 23. According to the Zacks Consensus Estimate, analysts anticipate sales of $15.15 billion and earnings of $2.25 per share. Estimates for earnings have seen minor upward adjustments recently—from $10.10 per share to $10.11 for 2024, and from $10.51 to $10.59 for 2025 over the last month.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Trends in Earnings Estimates

Image Source: Zacks Investment Research

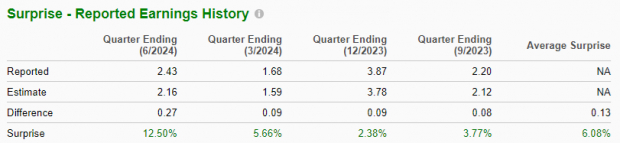

History of Earnings Surprises

IBM has demonstrated a strong performance over the previous four quarters, averaging an earnings surprise of 6.1%. This trend includes a notable 12.5% surprise in the last quarter.

Image Source: Zacks Investment Research

Expectations for Upcoming Earnings

IBM’s current earnings model does not indicate a likely beat for the third quarter. A successful earnings surprise usually aligns with a favorable Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). Currently, IBM holds an ESP of 0.00% and a Zacks Rank of #3, suggesting limited potential for a surprise.

Key Influences on Third Quarter Results

In the upcoming quarter, IBM focused on enhancing its generative artificial intelligence (AI) capabilities, particularly within its Threat Detection and Response Services through the launch of the IBM Consulting Cybersecurity Assistant. This initiative aims to improve the detection and response to security threats, integrated into IBM’s watsonx data and AI platform.

Moreover, IBM partnered with the United States Tennis Association to introduce features powered by generative AI for the US Open. This collaboration is designed to enhance fan engagement and is expected to contribute additional revenue within the Consulting segment.

The Zacks Consensus Estimate for the Consulting segment stands at $5.22 billion, with IBM’s model estimating $5.19 billion.

This quarter also saw IBM working alongside Microsoft Corporation (MSFT) to bolster cybersecurity operations, showcasing a strategic union in the tech landscape as both companies utilize their strengths in AI and cloud computing.

To further cement its position, IBM has completed acquisitions of StreamSets and webMethods. These moves are aimed at enhancing the company’s AI and automation capabilities, which should lead to increased efficiency across its software offerings. The Consensus Estimate for the Software segment is at $6.41 billion, while IBM’s own model predicts $6.48 billion.

Despite these advancements, IBM confronts intense competition from Amazon Web Services and Microsoft Azure. The company’s shift to a cloud-oriented model has been slow, and lingering issues such as weakness in its traditional businesses and foreign exchange fluctuations pose ongoing challenges.

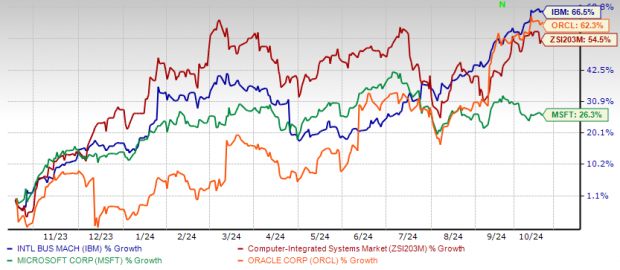

Stock Performance Overview

IBM’s stock has risen by 66.4% over the past year, outperforming the industry gain of 54.5% and exceeding rival companies like Microsoft and Oracle Corporation (ORCL).

One-Year Price Performance

Image Source: Zacks Investment Research

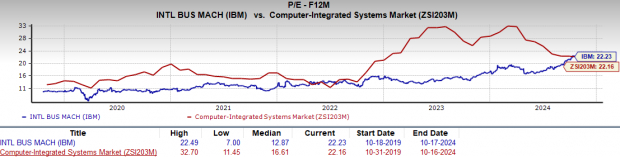

Current Valuation Insights

From a valuation perspective, IBM appears to trade at a premium compared to its industry peers, with a current price/earnings ratio of 22.23 against the industry average of 22.16 and the company’s historical mean of 12.87.

Image Source: Zacks Investment Research

Investment Perspective

IBM is well-positioned to capitalize on the growing interest among businesses for cloud-agnostic strategies that prioritize hybrid cloud and AI solutions. The rising volume of cloud workloads continues to create demand in the tech space.

However, frequent acquisitions heighten integration risks, potentially stressing IBM’s balance sheet due to high levels of goodwill and intangible assets. Competitive pressures and limited avenues for cost reduction could also put margins under strain, possibly affecting product launches.

Final Thoughts

With a Zacks Rank of #3, IBM is in a stable position, and prospective buyers may wish to proceed with caution. The stock trades at elevated valuation metrics, leading some investors to consider waiting for more favorable conditions to invest. Nonetheless, the performance of a single quarter may not be critical for long-term shareholders, who can hold their positions as IBM expects growth from its analytics, cloud computing, and security services.

The company anticipates benefits from its emerging focus on hybrid cloud and AI, particularly in the Software and Consulting segments. As it improves its earnings outlook, investor sentiment is also becoming more positive. These factors may provide sound justification for long-term investment.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from a current list of 220 Zacks Rank #1 Strong Buys. These stocks are considered “Most Likely for Early Price Pops.”

Since 1988, the full list has significantly outperformed the market, averaging a gain of +23.7% per year. Give these selected 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free. Click to get this report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.