Can New CEO Lip-Bu Tan Turn Around Intel’s Financial Fortunes?

As competition intensifies in the semiconductor sector, Intel Corporation INTC has fallen behind its peers and missed expectations. However, the appointment of Lip-Bu Tan as CEO raises questions: Could Intel become this year’s leading turnaround stock? Will its shares climb back up after reaching lows last seen in 1997? Let’s delve into the situation.

Investor Optimism Rises with Lip-Bu Tan’s Leadership

Intel has faced challenges in its manufacturing sector and remains a minor player in the artificial intelligence (AI) semiconductor market. Over the past year, the company’s shares dropped by 47.8%, largely due to the previous CEO, Pat Gelsinger, struggling to enhance the product lineup.

The market has responded positively to Lip-Bu Tan’s recent appointment as CEO on March 18, with Intel’s shares rising over 10% in after-hours trading. Investors are hopeful that Tan can restore stability and return Intel to its status as a chip industry leader.

Tan brings a proven track record to the role. As CEO of Cadence Design Systems from 2008 to 2021, he significantly increased operating margins, doubled revenue, and lifted the company’s stock price by nearly 2,700%.

Tan is already familiar with Intel’s operations, having served on its board until August. His vision includes refocusing the company on engineering and spinning off non-core assets.

Aiming for competitive strength, Tan plans to develop a new AI platform after Intel’s earlier Falcon Shores AI accelerator fell short. The company is also working on Jaguar Shores, a next-generation AI accelerator targeting the data center market to keep pace in the AI sector.

Furthermore, Tan’s strategy involves streamlining operations through cost reductions, enhancing the balance sheet, and aligning manufacturing processes with customer needs.

Positive Signals for Intel’s Future

Several developments could bolster Intel’s foundry business. Reports suggest that the Taiwan Semiconductor Manufacturing Company Limited (TSMC) may consider acquiring a stake in Intel’s foundry operations. The growing demand for AI chips is propelling growth in the foundry sector, particularly benefiting TSMC’s chip production leadership, which could indirectly help Intel.

Intel plans to launch the Panther Lake central processing unit (CPU) by the second half of 2025, which will utilize the 18A process node. Notably, the 18A technology is also being made available to external customers like Amazon.com, Inc. and Microsoft Corporation, a strategic move to enhance foundry business prospects. Intel remains a key player in the PC CPU market.

Evaluating Intel’s Potential for Buy Recommendations

With Lip-Bu Tan at the helm and Intel’s foundry business poised for recovery through new deals and initiatives, holding onto INTC stock might be warranted.

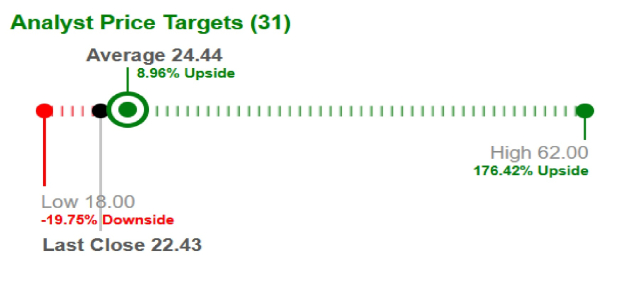

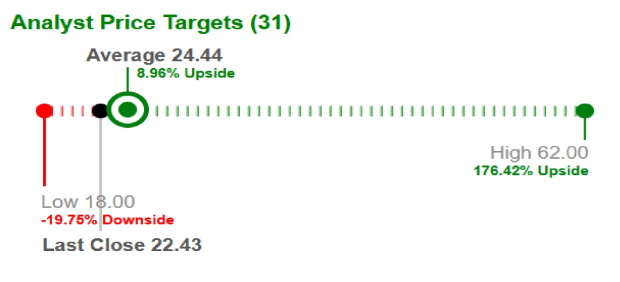

A rebound for Intel isn’t far-fetched; analysts are optimistic and have raised INTC’s average short-term price target by nearly 9%, now at $24.44, up from $22.43. The highest target estimates a potential upside of 176.4%, reaching $62.

Image Source: Zacks Investment Research

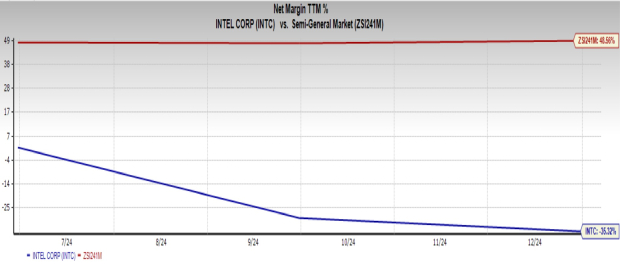

Nonetheless, challenges remain for the company. In fiscal 2024, Intel reported an $18.8 billion net loss compared to a $1.7 billion profit in fiscal 2023. The firm’s negative net profit margin of 35.3% starkly contrasts the 48.6% margin typical of the Semiconductor – General industries, indicating that expenses are surpassing revenues, thus threatening financial stability.

Image Source: Zacks Investment Research

Additionally, tariffs imposed during President Trump’s administration have complicated matters for Intel, particularly due to the company’s significant revenue exposure to China. Thus, the challenge facing Tan as he attempts to revitalize the company could be substantial. Investors may want to wait for improved financial results and resolution of tariff issues before committing to INTC stock.

Currently, Intel holds a Zacks Rank of #3 (Hold). For a list of today’s Zacks Rank #1 (Strong Buy) stocks, click here.

Zacks’ Research Chief Picks the Most Promising “Stock”

Our expert team has identified five stocks with the highest potential for a 100% gain in the coming months. Among these, Director of Research Sheraz Mian has spotlighted one stock projected to experience significant growth.

This selection stands out as one of the most innovative in the financial sector. Boasting a rapidly expanding customer base (over 50 million) and a broad array of advanced solutions, this stock shows great promise for substantial gains. While not all of our elite picks succeed, this one may outperform previous Zacks’ top stocks like Nano-X Imaging, which surged by 129.6% within just nine months.

For more recommendations from Zacks Investment Research, you can download our report on the 7 Best Stocks for the Next 30 Days.Click here for access.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Intel Corporation (INTC): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.