“`html

Key Points

-

AMD estimates its second-quarter revenue will grow 35% year over year.

-

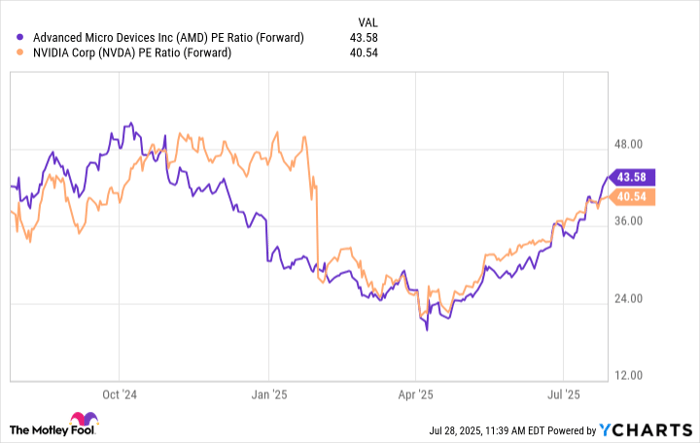

AMD trades at a higher premium than the industry leader, Nvidia.

-

Investors are advised against trying to time the market based on earnings due to the lack of direct correlation with stock price movements.

Advanced Micro Devices (NASDAQ: AMD) anticipates a revenue of $7.4 billion for its fiscal second-quarter earnings report on August 5, which represents a 35% increase compared to the previous year. The stock has risen 94% over the past three years, primarily driven by the AI boom.

However, AMD is currently trading at over 43 times its forward earnings, which is higher than Nvidia’s valuation at 40 times forward earnings. Despite strong earnings performance in the past 10 quarters, AMD’s stock price reactions have varied, indicating that market behavior may not align with expected earnings outcomes.

“`