Apple: Is the Tech Giant Still a Smart Investment?

Apple (NASDAQ: AAPL) has made many investors wealthy, boasting a staggering stock return of over 250,000% since 1980. A $1,000 investment from that time would now be worth more than $2.5 million! The company has continuously evolved, gaining massive success with the launch of the iPhone in 2007, which defined its business model.

However, some may now wonder if Apple can continue to offer substantial returns for new investors. Today, Apple is valued at over $3.8 trillion, with more than 2.2 billion people around the world using its iOS devices.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Even though Apple may be past its rapid growth stage, it remains a distinctive and impressive business that investors should not overlook.

Here’s what investors might anticipate from Apple’s stock in the future.

Can Apple Spark Growth Like Before?

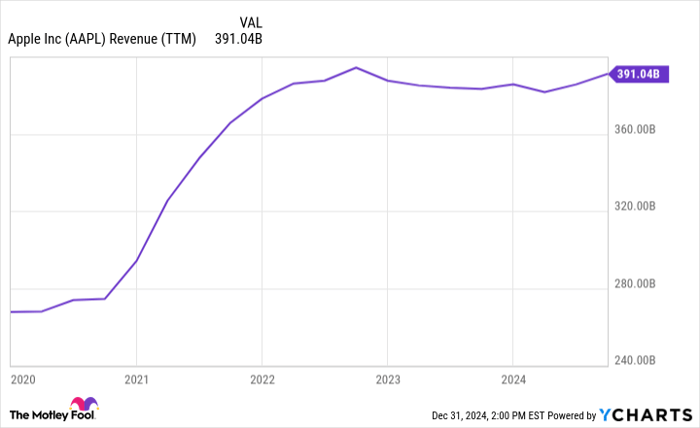

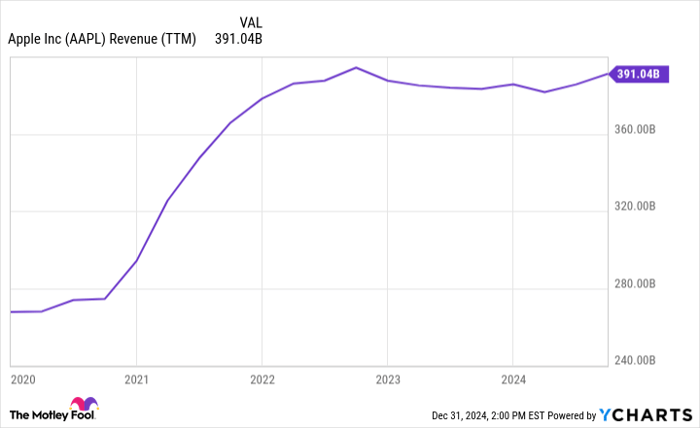

The impact of the iPhone was transformative, changing how we use cellphones forever. This device significantly contributed to Apple becoming the powerhouse it is today, generating $391 billion in revenue in 2024. Notably, over half of that ($201 billion) came from iPhone sales, with an additional $96 billion from subscription services, primarily for iPhones.

While Apple typically releases a new iPhone every year, convincing customers to upgrade has become more challenging in recent times. After the first iPhone with 5G capabilities launched in late 2020, revenue growth has struggled to keep pace.

AAPL Revenue (TTM) data by YCharts.

This doesn’t signify the end of Apple’s growth or the iPhone line. The company’s ecosystem is well-regarded for its loyalty, suggesting that many users will continue to engage with iOS devices, upgrading as necessary. Nonetheless, Apple likely needs a new hit product to reignite growth similar to its earlier successes.

In early 2024, Apple introduced its high-end augmented reality headset, the Apple Vision Pro. However, weak sales led the company to cut production by nearly 50%. Additionally, the launch of new artificial intelligence (AI) software, known as Apple Intelligence, has reportedly not garnered much excitement from customers so far.

Financial Stability Acts As A Safety Net for Investors

One cannot completely count Apple out, given its vast resources and dedicated user base. A successful product could lead to significant gains, as Apple is adept at rapidly scaling new offerings. The company excels in financial management, using its profits to enhance shareholder value.

This year, Apple amassed $108 billion in free cash flow from its $391 billion in revenue. Notably, it has raised its dividend for 12 consecutive years and invests billions repurchasing shares, which in turn boosts earnings per share (EPS). Over the past decade, Apple’s revenue has grown by 95%, while its EPS has surged by more than 227%.

Higher EPS typically leads to a higher stock price. Even without substantial revenue growth, Apple could serve as a valuable long-term investment if it maintains strong cash flow from its existing business. Its services segment is growing quickly and is also highly profitable, indicating potential for future success.

Investors Should Be Cautious About Timing

Although Apple demonstrates impressive earnings per share growth, this does not entirely replace the necessity for tangible revenue expansion.

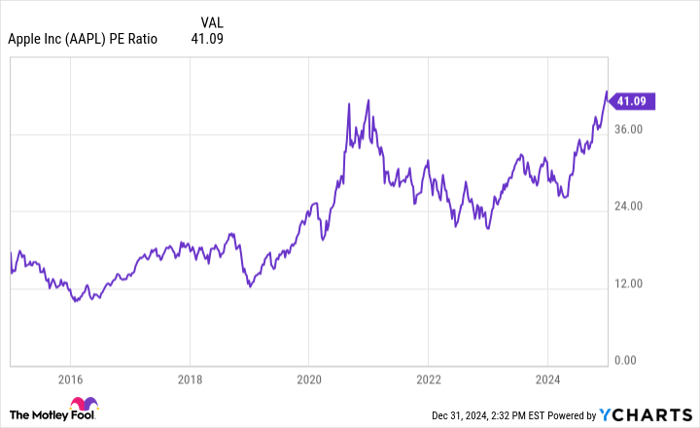

Investors must exercise caution regarding the stock price while Apple looks for a new growth driver. The market seems to have priced in positive expectations regarding Apple Intelligence, resulting in the stock’s price-to-earnings (P/E) ratio reaching its highest levels in years.

AAPL PE Ratio data by YCharts.

With estimates for 2025 earnings, the stock’s forward P/E ratio stands at 34. If analysts are correct about Apple averaging 13% to 14% annual earnings growth over the next three to five years, this seems high. A price/earnings-to-growth (PEG) ratio of 2.5 is the highest I would consider for a quality firm like Apple, leaving investors exposed to potential losses if the company does not meet these expectations.

Despite being a strong company, it will likely be challenging for Apple stock to achieve outstanding returns given its current valuation without a new innovative growth driver. Until such a catalyst arrives, investors should manage their expectations and proceed with caution.

A New Investment Opportunity May Be on the Horizon

Do you ever feel like you’ve missed the chance to buy into successful stocks? If so, you may want to pay attention.

Our team of expert analysts occasionally issues a “Double Down” stock recommendation for companies poised for growth. If you fear you’ve missed your opportunity to invest, now may be the time to act. The statistics speak volumes:

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $348,216!

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $47,425!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $480,681!

Currently, we are issuing “Double Down” alerts for three incredible companies, and another chance like this may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.