Microsoft Earnings Report: What to Expect Ahead of April 30

As the first quarter earnings reports begin to emerge, major tech companies are set to follow suit. Microsoft’s earnings announcement on April 30 is particularly anticipated, as insights into its core products and AI developments could significantly influence market trends.

Analyzing Microsoft’s Performance Ahead of Earnings

Microsoft (NASDAQ: MSFT), currently the world’s second-largest company with a market capitalization of $2.76 trillion, has caught investors’ attention. Following a 20% drop from its all-time high, analysts are eyeing whether the earnings release could propel the stock higher.

The intelligent cloud division remains a focal point for investors. Azure, Microsoft’s cloud computing product, grew at a remarkable 31% last quarter, continuing its trend of 20% to 30% growth. This division benefits from two major trends: the rise of AI and an ongoing migration to cloud services. Many companies require powerful infrastructure to run AI workloads, making cloud solutions more attractive than maintaining expensive on-premise supercomputers. Additionally, transitioning to the cloud helps clients mitigate risks associated with on-site failures while delegating maintenance issues to Microsoft.

Investors will closely monitor the growth trajectory of Microsoft’s cloud services. Continued revenue increases in this area would suggest resilience, potentially leading to increased share purchases by investors who view the division as insulated from economic fluctuations.

In addition, Microsoft’s productivity and business processes segment, which includes Microsoft 365 and LinkedIn, also warrants attention. Any reduction in client spending could signal economic uncertainty. Conversely, strong revenue results and positive management guidance could rejuvenate the tech sector, fostering renewed market interest.

Microsoft’s Valuation Amid Market Adjustments

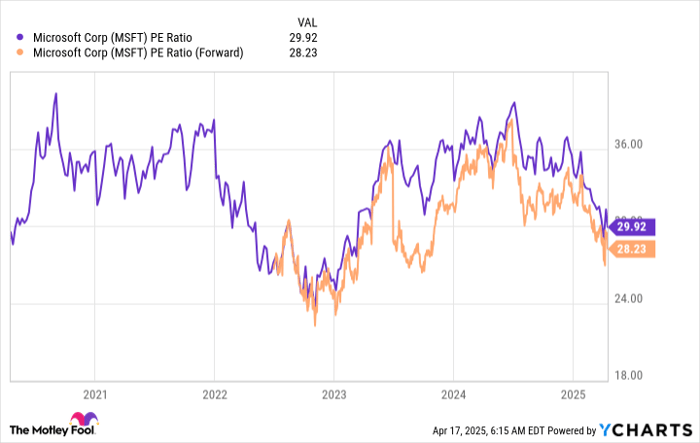

Despite a recent sell-off, Microsoft’s shares are trading at levels reminiscent of mid-2023, challenging valuations across the broader market. The current price reflects a 30 times trailing earnings and 28 times forward earnings ratio, indicating that the stock may not be as cheap as some investors hope. Historically, Microsoft has maintained a premium valuation due to its consistent execution and robust product offerings. However, competition from peers poised for faster growth could hinder its appeal relative to alternatives in the market.

As the earnings date approaches, interest will heighten regarding whether investors should take a chance on Microsoft shares or explore lower-priced options available elsewhere.

Should You Consider Microsoft for Your Portfolio?

Before investing in Microsoft, it’s essential to weigh expert recommendations.

The Motley Fool Stock Advisor recently highlighted its view that Microsoft is not among the top 10 stocks for potential returns at this time. Historically, companies like Netflix and Nvidia, which were early recommendations, have generated impressive long-term returns for investors.

For instance, if you invested $1,000 in Netflix shortly after its recommendation, you’d have seen it grow to approximately $532,771!

Furthermore, it’s important to consider that the Stock Advisor has achieved an average return of 781%, outperforming the S&P 500’s 149% return. For those looking for optimized investment opportunities, now could be the moment to explore alternative stocks that may deliver higher returns than Microsoft.

Discover the 10 recommended stocks now »

Keithen Drury has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool also recommends long January 2026 $395 calls and short January 2026 $405 calls on Microsoft.

The views and opinions expressed herein are those of the author and do not reflect those of Nasdaq, Inc.