Netflix Financial Highlights Q1-Q3 2025

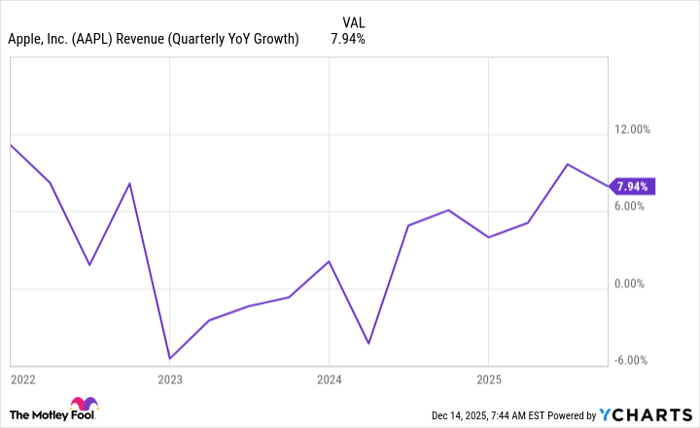

Netflix (NASDAQ: NFLX) reported a revenue of $33.1 billion for the first nine months of 2025, representing a 15% year-over-year increase. Operating income grew by 28%, and free cash flow reached $2.7 billion in Q3 2025. Despite these gains, the company’s stock has faced challenges, currently trading 29% below its peak, affected by market sentiment surrounding the proposed $82.7 billion acquisition of Warner Bros Discovery assets.

Netflix is also navigating a turbulent stock environment, experiencing a 10% drop after announcing Q3 diluted earnings per share of $5.87, which fell short of analyst expectations due to unexpected expenses. The market’s concerns about Netflix potentially taking on $59 billion in debt have further pressured its share price, which is currently trading at a price-to-earnings ratio of 39.8, down 23% over the past year.

Looking ahead, Netflix remains focused on enhancing its content offerings and plans to expand into live sports, including MLB games in the upcoming year. However, cautious investors are advised to evaluate the company’s valuation before making purchase decisions.