Nvidia’s Future with Blackwell: Buying Opportunities or Caution?

As generative artificial intelligence (AI) evolves, advanced chipsets known as graphics processing units (GPUs) are key to driving innovation. Currently, Nvidia (NASDAQ: NVDA) holds a commanding lead in the GPU market with its A100 and H100 chipsets.

These chips have significantly boosted Nvidia’s revenue and profits in recent years. However, the upcoming Blackwell series GPUs may prove to be the company’s most critical product to date.

With the Blackwell launch approaching, is now the right moment to invest in Nvidia stock? Here’s a crucial indicator to consider.

Jensen Huang: A Marketing Pro

CEOs do more than manage—many are effective marketers, as exhibited by Nvidia’s CEO Jensen Huang. In a recent CNBC interview, he asserted that demand for Blackwell is “insane,” emphasizing that “everybody wants to have the most and everybody wants to be first.”

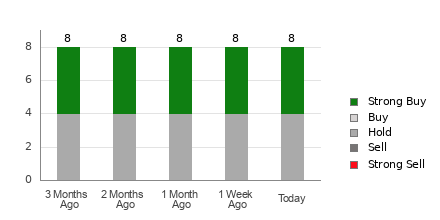

Early indicators suggest strong interest in Blackwell GPUs. Despite this, a striking statistic has captured my attention regarding insider stock behavior.

Image source: Getty Images.

Nvidia Insiders and Stock Sales

“Insiders” refer to members of a company’s board, senior executives, or anyone who owns over 10% of the company’s shares. Notably, several Nvidia insiders have sold shares throughout 2024. While some of these transactions follow pre-arranged selling plans, a concerning detail stands out.

Public records indicate the last insider purchase occurred in December 2020, when CFO Colette Kress acquired 200 shares on the open market.

Is Now the Time to Buy Nvidia Stock?

Understanding the strict regulations imposed by the Securities and Exchange Commission (SEC) on insider trading is crucial. Currently, Nvidia insiders likely possess valuable insights about Blackwell that have yet to be disclosed to the public.

This information could pertain to production volumes, purchase orders, or backlog trends. Thus, should an insider make a large stock purchase shortly before Blackwell’s launch, it may raise eyebrows.

Let’s take a broader view. Nvidia’s success in AI has formed the backbone of its rally in recent years. Developing a new product after the H100 was a significant undertaking. Insiders have had ample opportunity to acquire shares in anticipation of favorable outcomes from Nvidia’s research and development investments.

On the other hand, insiders may be selling shares because they believe Nvidia’s stock is unlikely to skyrocket again in the near future. Notably, prominent hedge funds led by Ken Griffin, David Shaw, and David Tepper have also reduced their Nvidia holdings, fueling further skepticism about potential investments in the company right now.

I expect Blackwell to act as a short-term catalyst for Nvidia’s growth. After the launch, watch carefully to see if insiders continue selling or if, after nearly three years, someone finally purchases shares. Such a move could indicate that insiders find Nvidia’s stock attractive and see room for growth.

Ultimately, while I’m optimistic about Blackwell sparking temporary gains for Nvidia, I recommend proceeding with caution for long-term investors. It may be wiser to avoid chasing trends and instead focus on steady growth stocks that are positioned for success over time.

Should You Invest $1,000 in Nvidia Right Now?

Before making any investment in Nvidia, consider the following:

The Motley Fool Stock Advisor analyst team recently identified ten stocks they believe are the best buys right now, and Nvidia is not among them. The selected stocks have strong potential for significant returns in the years ahead.

Reflect on this: When Nvidia was recommended on April 15, 2005… if you invested $1,000 at that time, you’d now have $826,130!*

Stock Advisor offers guidance for building a successful portfolio, with updates and two new stock recommendations each month. The service has more than quadrupled the S&P 500’s returns since 2002.*

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.