Evaluating PepsiCo’s Performance Ahead of Earnings

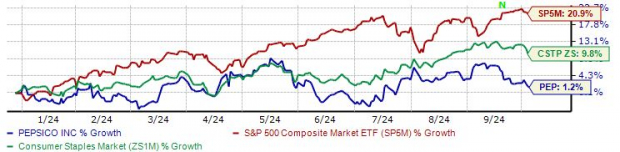

PepsiCo’s stock (PEP) has had a lackluster 2024, with a minimal 1.2% increase and mostly trading sideways. Investors have been reducing exposure to Consumer Staples stocks this year due to the Tech sector’s strong performance.

Analysts have adjusted their earnings forecasts downward for the upcoming quarter. The expected Zacks Consensus EPS of $2.30 indicates a 2.2% growth from the same period last year.

Revenue expectations are also slightly lower, with an anticipated $23.9 billion, reflecting a 1.9% increase from last year. However, PepsiCo’s revenue growth rate has been slowing down in recent times.

The current forward 12-month earnings multiple of 19.6X is below the five-year median of 23.6X, signaling dwindling growth expectations.

Is PepsiCo a Wise Investment?

Analysts have tempered optimism for PepsiCo’s upcoming earnings, adjusting their projections downward. While the stock has underperformed in 2024, a positive earnings report could revive its performance.

Investors should adopt a cautious approach due to the revised expectations. Given PepsiCo’s defensive nature, any disappointment in results may not lead to a significant drop in its share price.

Looking at Potential Stock Growth Opportunities

Considering potential stock growth, experts have identified five stocks likely to increase by over 100% in the near future. One standout among these is a financial company with innovative solutions and a growing customer base.

This top pick exhibits promising growth potential. While not all picks guarantee success, this stock could outperform previous Zacks’ choices like Nano-X Imaging, which surged by +129.6% in just over 9 months.

For more insights on potential stock growth, check out: Our Top Stock And 4 Runners Up

Stay informed with Zacks Investment Research: Download 5 Stocks Set to Double

Read the original article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.