SoundHound AI: A Potential Value in AI Amidst Nvidia’s Stellar Rise

Nvidia‘s (NASDAQ: NVDA) stock has shown remarkable performance, with an increase of over 800% since 2023 began. While many investors celebrate such substantial gains, not every company has the same growth prospects. Companies need major growth drivers to sustain such impressive returns.

SoundHound AI (NASDAQ: SOUN) is one company that may possess this potential. It plays a significant role in a specific area of the artificial intelligence (AI) landscape and currently has a substantial backlog for its offerings.

Growing Opportunities for SoundHound

SoundHound AI specializes in technology that understands human speech and can complete various tasks based on voice commands. Its applications are already seen in processing restaurant orders and enhancing in-car digital assistants, but the capabilities of its technology reach further.

In the automotive space, SoundHound has teamed up with Stellantis, a major automaker, to incorporate its technology into vehicles in Europe and Japan. This partnership provides drivers access to advanced generative AI features, improving upon the standard voice assistants currently in use. Success with other car manufacturers and expanding into new markets could lead to considerable growth for this segment.

Additionally, SoundHound collaborates with various companies in the restaurant industry to automate phone and drive-thru orders, reducing labor costs for these businesses. The company claims its AI assistants excel in both speed and accuracy, ensuring a satisfactory customer experience. While SoundHound serves notable clients like White Castle and Jersey Mike’s, there remains significant growth potential if it can attract larger fast-food chains.

The possible expansion into new applications could allow SoundHound AI to achieve even higher levels of success.

However, this raises the question: Does this potential compare to Nvidia’s performance?

SoundHound Lacks Nvidia’s Key Asset

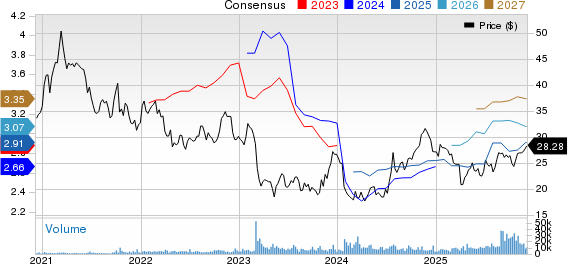

During the second quarter, SoundHound reported $13.5 million in revenue, representing a 54% increase year-over-year. While this growth is commendable, it remains relatively small compared to other AI firms.

Investors should pay attention to SoundHound’s backlog, which currently sits at $723 million. This figure has doubled from the previous year, indicating that demand for its products is surpassing its capabilities to implement them with clients.

SoundHound’s prospects are influencing its valuation, creating optimism on Wall Street.

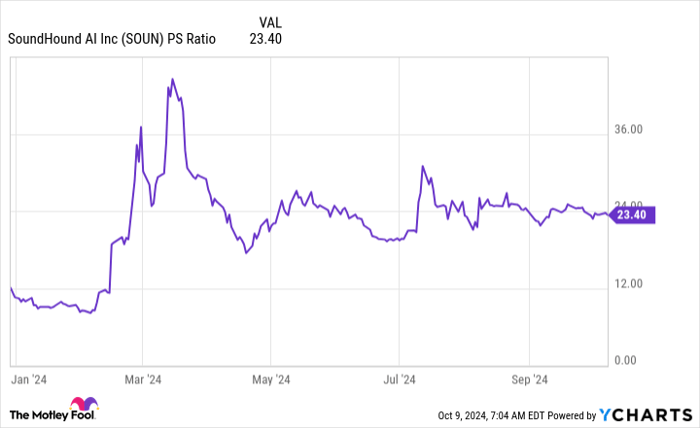

SOUN PS Ratio data by YCharts.

Currently trading at 23 times sales, SoundHound’s stock carries a premium valuation. In comparison, Nvidia began 2023 trading at about 15 times forward earnings, a bargain relative to the current forward earnings ratio of 47.

SoundHound’s elevated valuation might limit its growth potential. However, if it transitions into a business generating $100 million in quarterly revenues, it could potentially see stock performance akin to Nvidia’s.

Should SoundHound reach that mark at a valuation of 20 times sales, it would push its worth to $8 billion, reflecting a 370% increase from its current market cap. While this return appears promising, it still pales compared to Nvidia’s historic results.

The premium price of SoundHound stock could hinder it from achieving returns similar to Nvidia’s. Nonetheless, it could still be a rewarding investment. Investors should remain realistic, considering the specialized applications for its products and the company’s size. Serious profits are possible, but Nvidia-like results might be overly optimistic.

Is It Time to Invest $1,000 in SoundHound AI?

Before making an investment in SoundHound AI, consider this:

The Motley Fool Stock Advisor team has identified the 10 best stocks to buy right now, and SoundHound AI did not make the list. The stocks selected could yield impressive returns in the upcoming years.

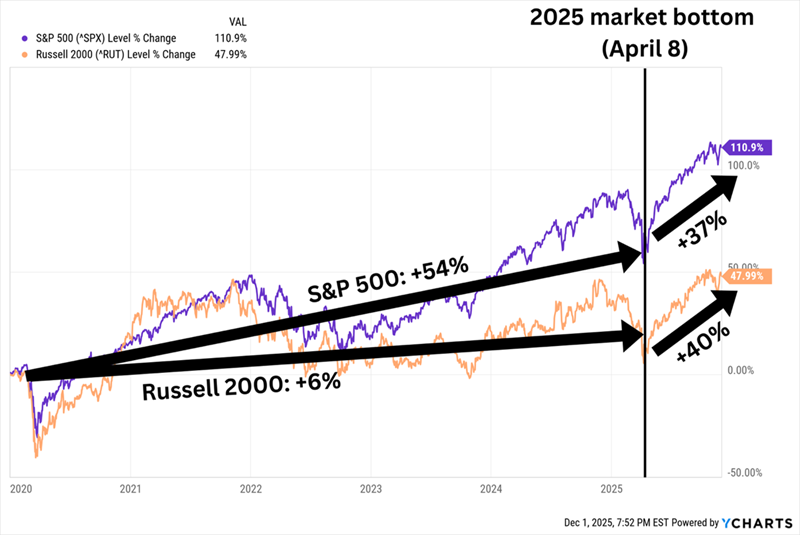

On April 15, 2005, Nvidia appeared on this list… had you invested $1,000 at that time, you’d have $826,130!*

Stock Advisor offers investors a straightforward strategy for accomplishing financial goals, complete with portfolio guidance, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool also recommends Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.