Understanding Tesla’s Growth Potential Amid Valuation Concerns

Tesla (NASDAQ: TSLA) presents a risky investment, similar to many stocks in today’s market where risk often accompanies potential rewards. Investors need to assess whether the risk/reward ratio aligns favorably for Tesla. Here’s an analysis of the situation.

Current Valuation vs. Growth Potential

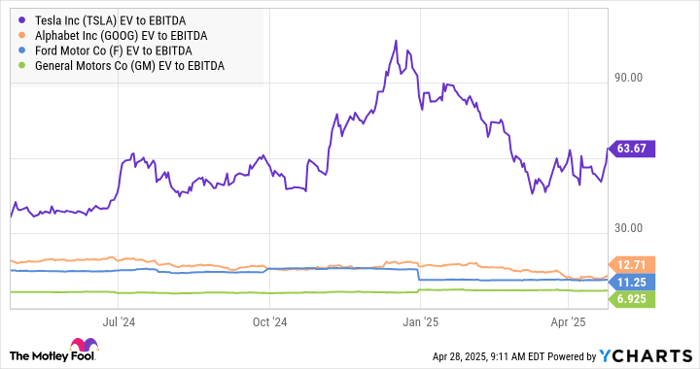

Critics often highlight Tesla’s current valuation based on earnings, cash flow, and sales, concluding that the stock appears overvalued. For instance, examining Tesla’s enterprise value (market cap plus net debt) against earnings before interest, taxation, depreciation, and amortization (EBITDA) reveals disparities with other major players, including Alphabet (NASDAQ: GOOG).

Clearly, Tesla’s valuation as a car manufacturer doesn’t suffice on its own.

TSLA EV to EBITDA data by YCharts.

However, assessing Tesla solely as a car company fails to capture its broader investment appeal, primarily driven by its ambitions in the robotaxi sector. For example, ARK Invest estimates a potential share value of $2,600 by 2029, attributing only 9% of that to its car business and a striking 88% to its robotaxi initiatives.

Evaluating Tesla as a Value Growth Stock

While it’s essential to recognize Tesla as a growth stock, determining whether it represents a good value in this context is a distinct challenge. The investment is indeed speculative. Management confirmed plans to sell unsupervised full-service driving (FSD) on the Model Y in Austin by June. Yet, production of the dedicated robotaxi, Cybercab, will not commence until 2026, raising numerous questions about the technology’s viability.

Image source: Getty Images.

Challenges in Developing Robotaxis

Concerns exist regarding the commercial scalability of Tesla’s robotaxi model, including regulatory hurdles and the company’s ability to deliver on its promises. CEO Elon Musk has a history of making optimistic projections about FSD; he humorously referred to himself as “the boy who cried FSD” during a 2023 earnings call.

Yet, Tesla isn’t alone in facing these challenges. In 2016, Ford pledged robotaxi services by 2021 but has since scaled back those expectations. Similarly, General Motors‘ CEO Mary Barra stated in January that they expect a savings of about $1 billion by halting robotaxi development.

Reasons for Optimism in Tesla’s Future

Despite challenges, Tesla distinguishes itself from typical growth stocks. It leads the electric vehicle market, allowing it to scale operations effectively, thereby lowering vehicle production costs over time. This positioning enables Tesla to introduce more affordable models.

Moreover, Alphabet’s Waymo has been operational with commercial robotaxi services since 2018, validating the model’s market potential and consumer acceptance. Furthermore, Alphabet CEO Sundar Pichai has alluded to operational flexibility surrounding personal vehicle ownership in the robotaxi space, reinforcing the concept’s viability.

Image source: Getty Images.

Additionally, the withdrawal of competitors like Ford and General Motors from the robotaxi segment reduces competitive pressure on Tesla. As the leading EV manufacturer, Tesla aims to provide more efficient robotaxi services, leveraging extensive data from its vehicles to enhance FSD technology.

Conclusion: A Differentiated Growth Stock

Tesla unquestionably serves as a speculative growth stock; however, it carries less speculation than many growth companies currently trying to secure a foothold in the market with limited financial backing and brand recognition. Unlike companies wrestling for market validation, Tesla is solidly positioned within a robust and expanding industry, offering competitive advantages over rivals like Waymo.

Investing in Tesla does hold risks, especially regarding its robotaxi ambitions. However, for a diversified growth investor, it offers a compelling opportunity compared to many other high-risk growth stocks.

Given these factors, investing in Tesla may represent a more favorable risk/reward proposition than many alternatives in the market today.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Tesla. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.