Key Points

-

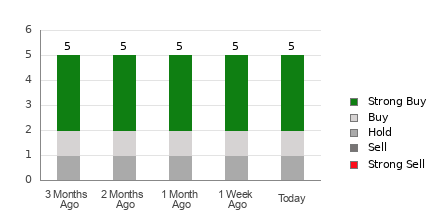

Alphabet (NASDAQ: GOOGL) shares have surged 63% this year, significantly outperforming peers like Nvidia at 37% and other members of the “Magnificent Seven.”

-

The rebound followed strong financial results and a favorable ruling in an antitrust lawsuit.

-

Alphabet’s Google Cloud backlog reached $155 billion, a 46% increase quarter over quarter, indicating robust future growth.

Alphabet’s Performance Drivers

After a slow start, Alphabet reversed its fortunes with stellar financial results, particularly in cloud computing and artificial intelligence (AI). The company also avoided severe penalties in an antitrust lawsuit, strengthening its market position. As it continues to leverage AI to enhance search algorithms and automate ad campaigns, Alphabet is expected to sustain growth.

Looking Ahead

Alphabet’s cloud division, while lower in margin than advertising, is expanding rapidly and contributing to revenue growth. With expanding operating margins and a faster customer acquisition rate, Alphabet’s stock remains attractive for long-term investors, presenting potential for strong performance into 2026.