Verizon Communications: A Focus on High Dividends Amid Market Turbulence

The markets have turned turbulent, with the Dow Jones Industrial Average (DJINDICES: ^DJI) down more than 11% from its early-year peak. This decline officially places the index in correction territory in 2025. Investors seeking high-yield stocks may see this sell-off as an opportunity to identify new investments.

Understanding the Highest-Yielding Dow Component

The highest-yielding stock in the Dow Jones Industrial Average is Verizon Communications (NYSE: VZ). Known primarily for its telecommunications services, Verizon is one of the few companies in the U.S. that operates within an effective oligopoly. However, there are several factors potential investors should weigh.

On the positive side, Verizon benefits from a subscription model, where customers pay a consistent monthly fee for essential services. As of the end of 2024, Verizon had 115 million wireless retail connections and an additional 31 million business connections.

Although individual bills may be modest, the cumulative revenue is substantial. In 2024, Verizon generated nearly $135 billion in total revenue. Much of this income is reliable due to the subscription nature of its services, making Verizon’s business model appealing in many respects.

However, it is essential to note that approximately 75% of Verizon’s revenue is derived from its retail sector. Retail customers can often be unpredictable, frequently switching providers for better prices and services. This competitive environment limits Verizon’s ability to increase prices, making service quality crucial for retaining customers.

To maintain its offerings, Verizon invests significantly in capital expenditures. In 2024, the company produced around $37 billion in cash flow, spending about 45% of that on capital investments.

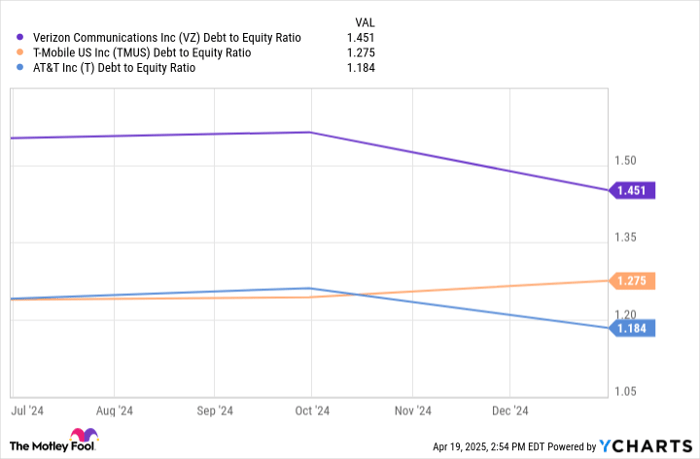

Data by YCharts.

Verizon’s requirement for significant capital investment, including the acquisition of broadband spectrum rights, has resulted in a considerable amount of debt. By the end of 2024, the company’s debt-to-equity ratio stood at nearly 1.5x, surpassing its closest competitors. This higher leverage places Verizon at a disadvantage given the ongoing financial demands of its business.

Assessing Verizon as an Investment

Verizon offers a robust dividend yield of 6.2%, making it attractive to income investors. The company generates sufficient cash flow to cover this dividend, maintaining a cash dividend payout ratio of around 60%. However, Verizon pays out a larger portion of its free cash flow as dividends than many of its peers, indicating vulnerability in its financial strategy.

Data by YCharts.

With rising debt, a substantial dividend commitment, and limited pricing power, much of an investor’s return from Verizon will likely stem from its dividend yield. Over the past decade, annualized dividend increases have been modest at only 2%, which doesn’t keep pace with inflation rates.

Looking ahead, Verizon forecasts revenue growth of between 2% to 2.8% and adjusted earnings growth of 3% for 2025. This outlook suggests limited potential for substantial dividend increases in the future.

Who Should Consider Investing in Verizon?

Ultimately, Verizon is likely to attract conservative investors focused on generating current income from their portfolios. While this strategy is valid, the infrastructure behind the dividend constrains Verizon’s broader investment appeal. Investors can likely depend on receiving dividends each quarter but shouldn’t expect much beyond that.

Should You Invest $1,000 in Verizon Communications Now?

Before investing in Verizon Communications, consider the following:

The Motley Fool’s analyst team recently highlighted their view on the 10 best stocks for current investment, and Verizon was not among them. The stocks selected have strong potential for significant returns in the forthcoming years.

For instance, if you had invested $1,000 in Netflix when it made the list on December 17, 2004, you would have $594,046 today!* Similarly, a $1,000 investment in Nvidia when it was recommended on April 15, 2005, would be worth $680,390 now!*

The Stock Advisor has an average return of 872%, significantly outperforming the S&P 500, which stands at 160%. Don’t miss out on the latest top 10 list, available upon joining Stock Advisor.

*Stock Advisor returns as of April 21, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.