Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), a titan in the business world, offers two classes of shares. The original Class A shares, existing since the company’s public debut, are now priced at over half a million dollars, reflecting an impressive performance over the years.

In the 1990s, Berkshire introduced Class B shares to make investing more attainable for average investors. With the rise of fractional shares, however, anyone can invest in a portion of Class A stock, now available for under $700,000. Should potential investors consider buying these Class A shares? Let’s explore this further.

Understanding Berkshire’s Valuation

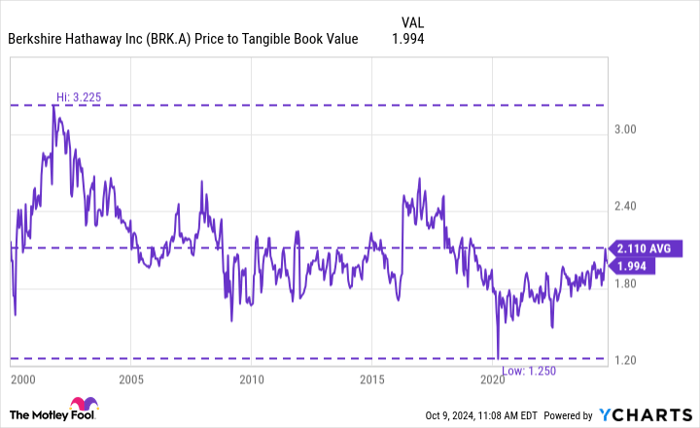

Stock prices alone don’t determine the value of an investment. For example, a company may have a high share price yet a low market capitalization. Therefore, Berkshire’s high trading price for Class A shares doesn’t necessarily imply overvaluation. One standard method to assess Berkshire’s value is the price-to-tangible book value (P/TBV) metric. This assesses the market value against the company’s net worth, a particularly relevant approach given Berkshire’s ownership of one of the largest insurance companies in the United States—Geico.

BRK.A Price to Tangible Book Value data by YCharts.

The data shows that while Berkshire’s P/TBV has generally increased, the stock trades below its historical average since 2000. The company’s price-to-earnings (P/E) ratio indicates that Berkshire is favorably priced relative to its own averages, though it isn’t far from levels seen in the previous decade (2010-2020).

BRK.A PE Ratio data by YCharts.

Is This the Right Time to Invest?

It’s evident that Berkshire holds significant assets in various sectors. The company operates the third-largest auto insurance provider in the U.S., one of North America’s largest railroads, notable mortgage and manufacturing businesses, as well as numerous assets in the energy sector. Additionally, Berkshire has an impressive cash reserve of over $271 billion, providing flexibility to acquire stocks or repurchase its own shares.

Historically, Berkshire has achieved extraordinary returns, boasting overall gains exceeding 4,300,000% from 1965 to 2023, compared to the S&P 500‘s 31,200% including dividends. This translates to a compound annual growth rate of 19.8% for Berkshire versus the S&P’s 10.2%.

The company is also navigating a transition period, with Vice Chairman Charlie Munger recently passing away at 99. Buffett, now 94, has limited years left in his leadership role. Nevertheless, a robust succession plan has been implemented, allowing capable colleagues to take the helm as needed.

Considering the company’s strengths and historical performance, investing in Berkshire Class A shares at prices below $700,000 might be a prudent choice. This is a stock you could hold long-term with less frequent monitoring required.

Should You Invest $1,000 in Berkshire Hathaway Now?

Before making any investment in Berkshire Hathaway, it’s vital to weigh your options:

The Motley Fool Stock Advisor analyst team has recently highlighted what they consider the 10 best stocks to buy right now, and interestingly, Berkshire Hathaway did not make the list. The stocks chosen could yield significant returns in the years ahead.

For example, when Nvidia was included in this list on April 15, 2005, a $1,000 investment at that time would be worth $826,069 today. *

Stock Advisor offers investors valuable insights and guidance for portfolio building, along with consistent updates and two new stock picks each month. The service has significantly outperformed the S&P 500 since its launch in 2002.*

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.