As U.S. markets prepare to close for Martin Luther King Day on Monday, investors are eagerly looking to Tuesday, January 21, for trading insights, especially with Netflix NFLX releasing its Q4 results.

With its stock price soaring over +70% in the past year, Netflix’s upcoming earnings report could be pivotal in determining if now is the right time to buy.

Image Source: Zacks Investment Research

What to Expect from Netflix’s Q4 Earnings

Netflix is projected to report a 14% increase in Q4 sales, reaching $10.12 billion, up from $8.83 billion a year prior. Additionally, analysts foresee a remarkable 98% jump in earnings per share (EPS), estimating it to hit $4.19, compared to $2.11 last year.

For the full fiscal year 2024, Netflix could see a total sales increase of 15%, resulting in $38.86 billion. Its annual earnings estimate is set at $19.77 per share, up 64% from $12.03 in 2023.

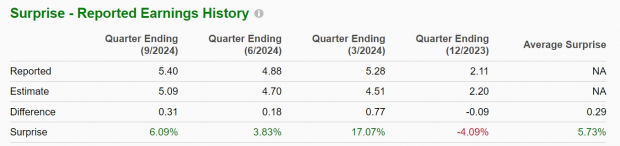

Remarkably, Netflix has beaten sales estimates in five straight quarters and has exceeded earnings expectations in three of the last four quarters, with an average EPS surprise of 5.73%.

Image Source: Zacks Investment Research

Subscriber Growth Outlook

As the leader in streaming content, Netflix is anticipated to add over 7 million subscribers in Q4, bringing its total to about 287.48 million. This represents a 10% growth from 260.28 million subscribers at the end of Q3 2024.

Considering Netflix’s Valuation

Currently trading around $860 a share, NFLX has a forward earnings multiple of 35.6X, which is higher than the S&P 500’s 22.2X and Disney’s 19X.

Despite the stock’s impressive performance over recent years, it currently trades below its five-year high of 88.5X forward earnings, and shows a slight discount compared to the median of 37.4X during that period.

Image Source: Zacks Investment Research

Final Thoughts

As it approaches its Q4 earnings announcement, Netflix holds a Zacks Rank #3 (Hold). Historically, NFLX tends to rise after reporting favorable quarterly performance, so it will be crucial for this report to confirm its ongoing growth trend following an extensive rally over the last year.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss your chance to explore our top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this selection has shown remarkable success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has surged +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Sheraz has handpicked the best 10 stocks from over 4,400 companies analyzed by Zacks Rank, giving you a head start. Be among the first to discover these newly released high-potential stocks.

See New Top 10 Stocks >>

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.