TSMC’s Impressive Q3 Results Reinforce Its Semiconductor Leadership

Taiwan Semiconductor Manufacturing Company (TSM), recognized as the leading semiconductor foundry globally, reported outstanding earnings for the third quarter of 2024. Surpassing expectations once again, TSMC is reinforcing its dominant status in the advanced chip market while drawing attention from investors.

Given its solid financial performance and rising demand for its technology, many are asking: Is TSM stock a good buy?

The evidence strongly supports a positive response. TSMC’s solid fundamentals, smart growth strategies, and leadership in high-growth markets make it an appealing investment opportunity.

Record-Breaking Q3 Results from TSMC

In Q3 2024, TSMC’s revenue reached $23.50 billion, showing a remarkable 36% increase compared to the same quarter last year. Additionally, it marked a 12.9% rise from Q2 2024. Net income soared by 51% year over year, resulting in $10.06 billion in profit, a clear indication of the company’s ability to grow profitably. Each ADR unit’s earnings rose 50.4% from last year to $1.94, exceeding the Zacks Consensus Estimate of $1.74.

These impressive results stemmed from high demand for 3nm and 5nm technologies, which collectively contributed 52% of total wafer revenues. TSMC’s gross margin improved to 57.8%, up 350 basis points from the previous year, while operating margin increased to 47.5% from 41.7%. Such figures highlight TSMC’s operational efficiency, even amidst rising costs, solidifying its reputation as one of the most profitable semiconductor firms.

Throughout 2024, TSMC has consistently reported better-than-expected outcomes across all quarters, with stock prices soaring 93% this year, far exceeding the S&P 500’s increase of 22.9% and the Zacks Computer & Technology sector’s 26.2% growth.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Despite its remarkable growth, TSM stock is still undervalued. Currently trading at a forward 12-month price-to-earnings ratio of 24.52, it falls below the sector average of 26.89. This discrepancy suggests an opportune moment for investment.

Image Source: Zacks Investment Research

TSMC’s Role in the Semiconductor Evolution

TSMC’s remarkable success is attributed mainly to its technological advancements. In the recent quarter, 3nm technology represented 20% of wafer revenues, while 5nm technology added 32%. These innovations are particularly sought after as artificial intelligence (AI) and high-performance computing (HPC) sectors require more advanced chips.

Currently, AI and HPC platforms generate over 51% of TSMC’s revenue, with the demand for AI-related server processors expected to triple in 2024. As AI and 5G technologies gain traction, TSMC’s advanced capabilities place it ahead of competitors like Samsung and Intel, making its stock a strong long-term investment pick.

Optimistic Outlook & Strong Guidance

Looking ahead, TSMC projects fourth-quarter revenues between $26.1 billion and $26.9 billion, representing a potential 35% year-over-year increase at the mid-range. Gross margins should remain robust between 57% and 59%, thanks to efficient capacity utilization and ongoing demand for its 3nm and upcoming 2nm technologies.

TSMC has also reported an impressive cash flow of $37.62 billion during the first three quarters of 2024. With capital expenditures expected to exceed $30 billion this year, the company is strategically investing in future growth to meet rising demand in AI, 5G, and the automotive sector.

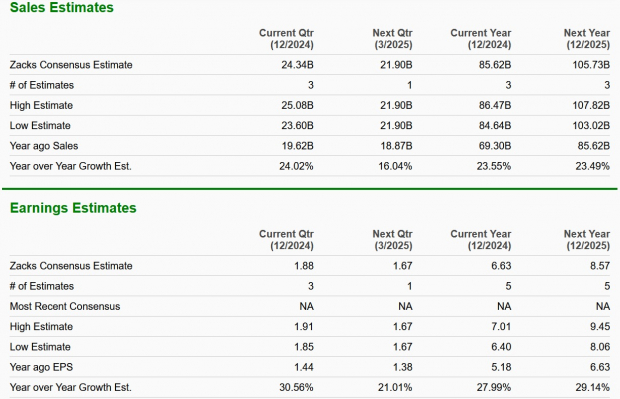

The Zacks Consensus Estimate suggests ongoing growth momentum for TSMC moving into the current and next years.

Image Source: Zacks Investment Research

Strong Customer Relationships Drive TSMC’s Growth

TSMC boasts a powerful customer base that includes industry giants like NVIDIA (NVDA), Amazon Web Services, Broadcom (AVGO), Intel (INTC), and Qualcomm. In 2023, 70% of TSMC’s revenues came from just ten major customers, which indicates strong partnerships that will likely fuel future growth.

As companies increasingly rely on TSMC for their most advanced chips, these long-lasting relationships create a steady revenue stream for the semiconductor leader.

Conclusion: Consider Buying TSM Stock

With stellar third-quarter results for 2024 and a stronghold on advanced chip manufacturing, TSMC emerges as a compelling investment opportunity. Robust margins, increasing demand from high-growth sectors like AI and HPC, and strategic investments position TSMC for enduring success. With stock currently trading at a relative discount, this moment presents a valuable chance to invest in TSM and benefit from its continued dominance and growth prospects.

TSMC holds a Zacks Rank #2 (Buy) paired with a VGM Score of B, indicating strong investment potential. Stocks with a VGM Score of A or B, combined with a Zacks Rank of #1 (Strong Buy) or #2, present appealing investment opportunities. Consequently, TSMC appears well-positioned as a top investment choice right now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Identifies Top Semiconductor Stock

Though it is only 1/9,000th the size of NVIDIA, which skyrocketed more than +800% since our recommendation, our new leading chip stock has significantly greater potential for growth.

With strong earnings growth and an expanding customer base, this company is well-equipped to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

For the latest recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double.” Click here to obtain this free report.

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.