Exploring AI’s Impact on Stock Market Gains

This year has been remarkable for stocks, with the S&P 500 (SNPINDEX: ^GSPC) solidifying bull market status. The index has reached multiple all-time highs and is now on track for a 26% increase by year-end. Similarly, the Nasdaq (NASDAQINDEX: ^IXIC) has surged 32%, while the Dow Jones Industrial Average (DJINDICES: ^DJI) rose 16%. Notably, over 75% of the 30 Dow stocks are also seeing positive motion this year, highlighting broad contributions across various sectors.

However, one sector has emerged as a standout this year: artificial intelligence (AI). Companies that are either developing AI technology or utilizing it to enhance their businesses have led the stock market surge. Notable performers include AI chip producer Nvidia (NASDAQ: NVDA) and AI software company Palantir Technologies (NASDAQ: PLTR), both achieving significant gains in their respective indices.

As we approach 2025, you might be wondering if there is still an opportunity to invest in this booming area or if it’s all played out. Let’s consider the facts.

Image source: Getty Images.

The Investor Appeal of AI

To understand the rising interest in AI investments, look at the commitment from major companies. Meta Platforms (NASDAQ: META) has declared AI as its primary investment focus for this year and plans to increase spending next year. Meanwhile, Amazon (NASDAQ: AMZN), through its Amazon Web Services (AWS), has significantly invested in AI, providing a range of services from chips to delivery optimization for its e-commerce business.

AI empowers businesses to reduce operational costs while enhancing customer offerings. This can lead to substantial revenue growth for firms involved in AI development, often reflected in favorable stock performance over time.

It is no surprise that both investors and companies view AI as a promising investment area. For instance, AWS achieved a $110 billion annualized revenue run rate, boosted by its AI product offerings. Additionally, Palantir recorded its highest profits in the latest quarter, driven by increasing demand for its AI-based software.

AI Pioneers: Palantir and Nvidia

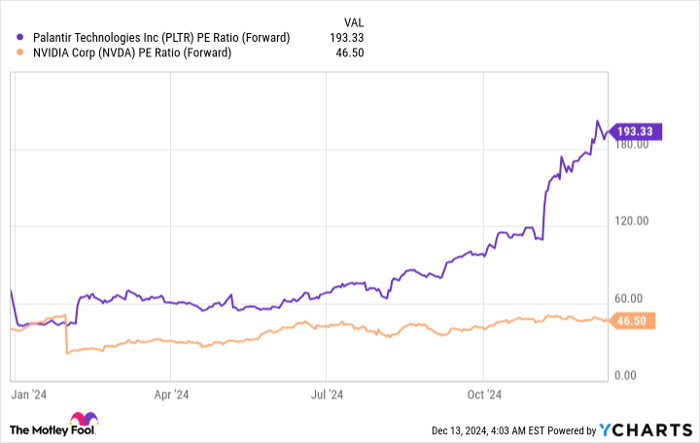

The companies at the forefront of the AI revolution, such as Palantir and Nvidia, have also experienced remarkable stock performance, as evidenced in the following chart.

PLTR PE Ratio (Forward) data by YCharts

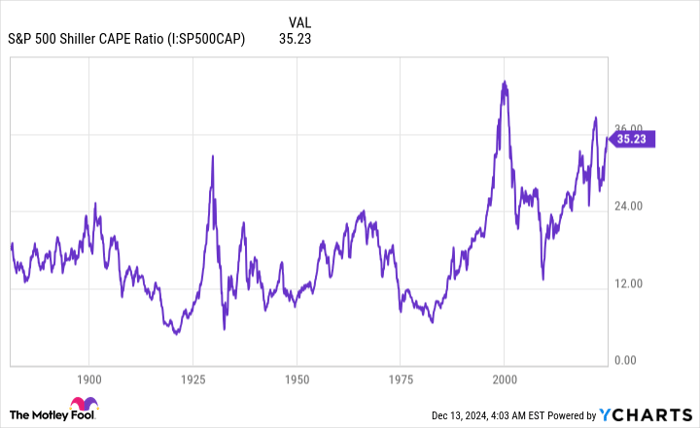

The overall stock market has become quite pricey, indicated by the S&P 500 Shiller CAPE ratio—an inflation-adjusted view comparing share prices to earnings over ten years—which is currently at some of its highest levels ever.

S&P 500 Shiller CAPE Ratio data by YCharts

Some may conclude that the peak AI-driven stock gains have already passed and that it is too late to invest. However, this view may overlook the potential for long-term growth. Despite the substantial rises seen in AI stocks this year, the associated investment opportunity aligns with a long-term horizon rather than a quick short-term win.

For instance, Meta’s CEO Mark Zuckerberg has noted that a “multiyear investment cycle” is expected before their AI services become profitable. Additionally, Nvidia’s CEO Jensen Huang indicated that around $1 trillion of outdated computing systems need replacement for this evolution in computing. Analysts forecast that today’s $200 billion AI sector could expand to $1 trillion by 2030.

This sets a stage where we might still be in the initial phase of AI expansion, suggesting that revenue growth for related companies is just beginning.

This development is encouraging for investors, indicating a window of opportunity within this exciting industry. Even stocks experiencing recent surges may still have significant long-term potential. Therefore, the interest surrounding AI is not merely a fleeting trend, but a potentially valuable investment area for the future.

Is Now the Right Time to Invest in Amazon?

Before purchasing stock in Amazon, take note:

The Motley Fool Stock Advisor research team recently highlighted their choice of the 10 best stocks for current investment, and Amazon was not included. The identified stocks have the potential for substantial returns in the coming years.

Consider a historical perspective: on April 15, 2005, Nvidia was featured on this list. Investing $1,000 at that time would have grown to $822,755!

Stock Advisor offers investors a straightforward path to success, featuring portfolio-building advice, regular analyst updates, and two new stock picks every month. Since its launch in 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times*.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Note: John Mackey, former CEO of Whole Foods Market, which is an Amazon subsidiary, serves on The Motley Fool’s board. Randi Zuckerberg, former director of market development for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is also a board member. Adria Cimino holds shares in Amazon. The Motley Fool recommends several companies, including Amazon, Meta Platforms, Nvidia, and Palantir Technologies. Please refer to their disclosure policy for more details.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.