Amazon Soars After Strong Third-Quarter Earnings Report

Amazon’s AMZN stock surged over +7% in Friday’s trading following an impressive third-quarter earnings report released after the market closed on Thursday.

The e-commerce leader is focusing on profitability, even as it expands into various business areas. This raises the question: Is now the time to invest in Amazon, especially with AMZN nearing its 52-week high of $201 per share?

Image Source: Zacks Investment Research

AWS Drives Strong Q3 Performance

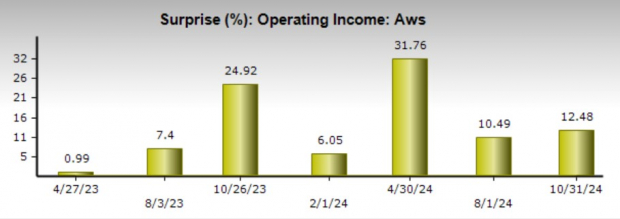

Amazon Web Services (AWS), the company’s cloud computing arm, played a crucial role in its robust Q3 results. AWS revenue for the quarter reached $27.45 billion, a 19% increase from the previous year, even though it fell short of the forecast of $27.57 billion.

On the positive side, Amazon’s AWS operating income came in at $10.44 billion, exceeding estimates by 12% and marking a significant increase from $6.97 billion in Q3 2023.

Image Source: Zacks Investment Research

In total, Amazon’s sales climbed 11% to $158.87 billion, with earnings per share (EPS) increasing 68% from $0.85 to $1.43. These results surpassed the Zacks Sales Consensus of $157.07 billion by 1% and beat the EPS Consensus of $1.14 by 25%.

Over the past year, Amazon has surpassed sales estimates in three of its last four quarters and has exceeded earnings expectations for eight consecutive quarters. The company has delivered an average EPS surprise of 25.85% in its four most recent reports.

Image Source: Zacks Investment Research

Assessing Amazon’s Valuation (P/E)

With its Q3 performance reinforcing projections for significant growth in both fiscal 2024 and 2025, monitoring Amazon’s valuation is essential for evaluating its future potential.

Currently, AMZN is trading at 39.3 times forward earnings. This is a premium compared to the S&P 500’s 24.2 times, although it is lower than Nvidia’s NVDA 47.1 times and Tesla’s TSLA 109.9 times.

Image Source: Zacks Investment Research

Conclusion

Currently, Amazon holds a Zacks Rank #3 (Hold). Following the post-earnings surge, long-term investors may still benefit from maintaining their Amazon positions at these levels.

Moreover, revisions in earnings estimates could rise in the upcoming weeks, potentially prompting a buy rating from Zacks.

Zacks’ Research Chief Identifies “Stock Most Likely to Double”

Our experts recently identified five stocks with the greatest potential for growth, particularly one highlighted by Director of Research Sheraz Mian. This innovative financial firm is gaining traction with a customer base exceeding 50 million and a range of cutting-edge solutions. Although not every pick is guaranteed success, this one could outperform previous Zacks winners like Nano-X Imaging, which rose by +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.