Market Reactions to Q3 Earnings: AMD and Eli Lilly Under Scrutiny

The 2024 Q3 earnings season is moving quickly, showcasing a range of companies announcing their quarterly results. Major companies such as Advanced Micro Devices (AMD) and Eli Lilly (LLY) recently reported earnings but experienced disappointing market reactions.

Were these reactions justified? Let’s examine each company’s results in detail.

AMD Achieves Record Data Center Revenues

In its latest earnings report, AMD exceeded the Zacks Consensus EPS estimate by 1.1% and generated sales that were 1.5% higher than anticipated. This performance reflects impressive growth rates of 31% in earnings and 17% in sales.

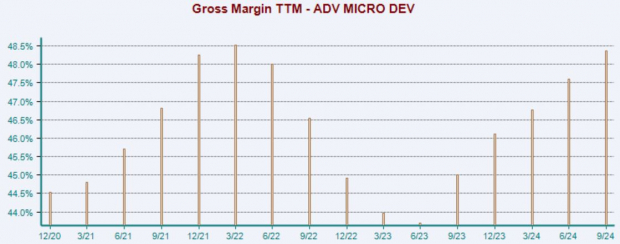

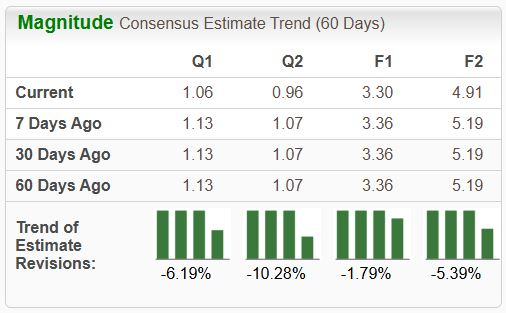

Increased profit margins significantly contributed to AMD’s success, highlighted by a gross margin of 54%, which marks a rise from 47% during the same quarter last year. This trend in margin growth has been a consistent positive factor over recent quarters.

The accompanying chart illustrates the company’s margins over the past twelve months.

Image Source: Zacks Investment Research

Looking ahead, AMD is projected to achieve record annual revenue in 2024, driven by strong growth in its Data Center and Client segments. The Data Center segment reported revenue of $3.5 billion, signifying a remarkable 122% increase year-over-year, fueled by a rise in AMD Instinct GPU shipments and stronger sales of AMD EPYC CPUs.

CEO Lisa Su commented:

“Looking forward, we see significant growth opportunities across our data center, client, and embedded businesses driven by the insatiable demand for more compute.”

Despite these record numbers, AMD’s stock fell nearly 5% so far in 2024. However, its valuation remains moderate, with a current PEG ratio of 1.1X, bettering the five-year median of 1.2X and far below the five-year high of 6.5X.

Image Source: Zacks Investment Research

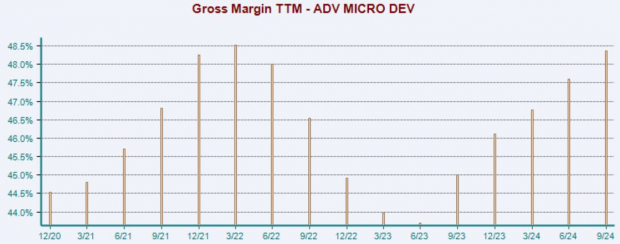

Nonetheless, the company’s earnings outlook has faced downward adjustments following this earnings report, a critical development to monitor.

Image Source: Zacks Investment Research

Eli Lilly Lowers Sales Forecast

Eli Lilly fell short of expectations in both EPS and sales, missing targets by 22% and 5%, respectively. Sales still grew substantially, increasing 20% year-over-year, while earnings per share (EPS) reached $1.18, boosted by low year-over-year comparisons.

The company attributed its strong sales growth to a combination of 15% higher sales volumes and a 6% increase in prices, with significant contributions from its major products, Mounjaro and Zepbound. The quarterly sales performance is illustrated in the following chart.

Image Source: Zacks Investment Research

However, the market reacted negatively, primarily due to a reduction in guidance. Eli Lilly adjusted its fiscal 2024 sales forecast from a range of $45.4 to $46.6 billion down to $45.4 to $46.0 billion.

Following this update, analysts have lowered their sales expectations for the current fiscal year, shown in the next chart.

Image Source: Zacks Investment Research

Despite the lowered outlook, Eli Lilly’s growth remains robust, projecting 110% EPS growth alongside a 34% increase in sales for this fiscal year. The demand for Mounjaro and Zepbound is expected to remain strong, bolstered by increasing consumer interest. Notably, Mounjaro sales reached $3.1 billion, marking a remarkable 120% increase year-over-year.

Conclusion

Both Advanced Micro Devices (AMD) and Eli Lilly (LLY) experienced disappointing market reactions to their quarterly earnings releases, despite reporting substantial growth.

In summary, both companies maintain a high-growth trajectory, with AMD benefiting from the rising interest in AI technologies and Eli Lilly riding the wave of demand for GLP-1 medications. The decline in Eli Lilly’s stock appears to be directly related to its lowered sales guidance, while poor market response to AMD was likely due to less-than-optimistic outlooks for the coming quarter.

Given the downward revisions in earnings forecasts for Eli Lilly alongside AMD’s tepid guidance, both stocks may face short-term volatility. However, their long-term growth potential appears intact, making them appealing options for investors willing to wait.

Discover Zacks’ Picks for Just $1

We’re serious.

A few years ago, we surprised our members by giving them a 30-day trial of all our picks for just $1. There’s no obligation to spend more.

Thousands seized this opportunity, while others missed out, thinking there had to be a catch. We want you to experience our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which yielded 228 positions with double- and triple-digit gains in 2023 alone.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today for free.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.