GameStop Shares Surge Following Strong Q4 Earnings Results

GameStop GME shares surged 11% in today’s trading session after the world’s largest video game retailer surpassed its Q4 earnings expectations following the release of its report after market hours on Tuesday.

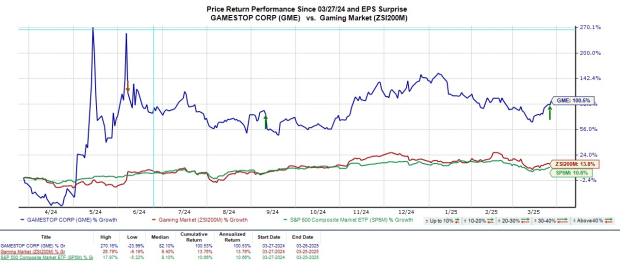

The increase was fueled by GameStop’s announcement of plans to invest in Bitcoin as a strategy to utilize its expanding cash reserves. Investors may be questioning whether now is the time to join this post-earnings rally, especially with GME boasting over 100% gains in the last year, despite being down 16% in 2025.

Image Source: Zacks Investment Research

GameStop’s Q4 Performance Overview

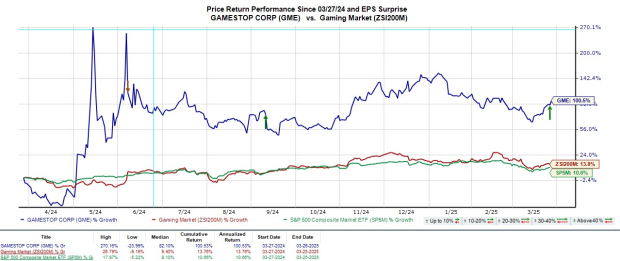

Due to effective cost-cutting measures, GameStop recorded a Q4 net income of $131.3 million, or $0.30 per share, far exceeding EPS expectations of $0.09. This marks a significant increase from the prior year’s Q4 earnings of $63.1 million, or $0.22 per share.

However, Q4 sales totaled $1.28 billion, which fell short of estimates of $1.45 billion and was down from $1.79 billion a year earlier.

Image Source: Zacks Investment Research

Annual Financial Review

In its fiscal 2025 closing results, GameStop reported annual earnings of $0.33 per share, a notable increase from $0.06 per share in FY 24. Nevertheless, total sales continued to decline, reaching $3.82 billion compared to $5.27 billion in FY 24.

The ongoing revenue decline has been linked to a shift towards digital gaming and intensifying competition from other retailers such as Best Buy BBY, Walmart WMT, and Amazon AMZN.

Image Source: Zacks Investment Research

Strengthening Financial Position

Aligned with its Bitcoin investment strategy, GameStop’s cash and equivalents surged to $4.75 billion, up from $921.7 million one year prior.

The company has also improved its operational efficiency, with total assets now at $5.87 billion compared to total liabilities of $945.6 million.

Conclusion

Despite the temptation to chase the current rally in GameStop shares, there may be more attractive buying opportunities in the future. Presently, trading at $28 a share, GME appears to be at a high valuation, even as management seems to be steering the company in a positive direction in light of ongoing revenue challenges.

GameStop’s Q4 Performance Overview

Due to effective cost-cutting measures, GameStop recorded a Q4 net income of $131.3 million, or $0.30 per share, far exceeding EPS expectations of $0.09. This marks a significant increase from the prior year’s Q4 earnings of $63.1 million, or $0.22 per share.

However, Q4 sales totaled $1.28 billion, which fell short of estimates of $1.45 billion and was down from $1.79 billion a year earlier.

Zacks Highlights Top Semiconductor Stock

Zacks has named a top semiconductor Stock that is only 1/9,000th the size of NVIDIA, which has seen over an +800% increase since our initial recommendation. While NVIDIA remains robust, our new leading chip Stock has significant growth potential.

The robust growth in earnings and an expanding customer base position it well to meet the growing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor industry is expected to soar from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Interested in Zacks Investment Research’s latest updates? You can download the 7 Best Stocks for the Upcoming Month for free. Click to receive this complimentary report.

GameStop Corp. (GME): Free Stock Analysis report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

Walmart Inc. (WMT): Free Stock Analysis report.

Best Buy Co., Inc. (BBY): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.