Last month, NVIDIA Corporation’s NVDA stock faced a significant drop due to concerns surrounding DeepSeek. Although much of the decline has been reversed, investors are now looking ahead to the upcoming fiscal 2025 fourth-quarter and full-year results, set to be released on February 26, after the market closes.

Is it wise to purchase NVIDIA stock before this earnings announcement, or would it be better to wait? Let’s explore the situation further.

Positive Earnings Outlook for NVIDIA

During the reporting quarter, NVIDIA introduced its highly anticipated Blackwell architecture. CEO Jensen Huang stated that demand for the Blackwell chips is remarkably high, thanks to their enhanced efficiency, faster artificial intelligence (AI) interface, and improved security features.

Major companies like Microsoft Corporation (MSFT) and Alphabet Inc. (GOOGL) have already placed orders for the Blackwell chips, while older Hopper chips remain popular due to their quality exceeding that of rival Intel Corporation (INTC).

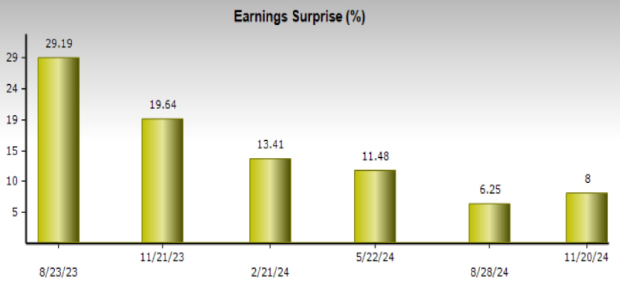

With strong demand for both current and future chips, NVIDIA is expected to exceed its revenue forecasts for the fiscal fourth quarter and the full year. Notably, NVIDIA’s impressive average surprise in earnings of 9.8% over the past four quarters suggests growth in their upcoming financial release, which may boost stock prices.

Image Source: Zacks Investment Research

NVIDIA’s Bright Future Despite Challenges

Although concerns regarding DeepSeek have been exaggerated, this competitor has launched an affordable large language model that could impact the AI sector. Nonetheless, NVIDIA’s graphic processing units (GPUs), essential for AI infrastructure, remain significantly pricier, which should sustain NVIDIA’s growth.

Reduced costs from competitors may eventually boost demand for computing power, ultimately benefiting NVIDIA’s stock. The company possesses the resources to introduce more budget-friendly options while further enriching the AI ecosystem.

NVIDIA’s established presence in the GPU market already provides it with a competitive edge. Additionally, its CUDA software platform is favored among developers compared to Advanced Micro Devices, Inc.’s (AMD) ROCm platform. The transition to alternative platforms is unlikely due to the complexity involved, further solidifying NVIDIA’s strong market position.

Reasons to Consider Buying NVDA Shares

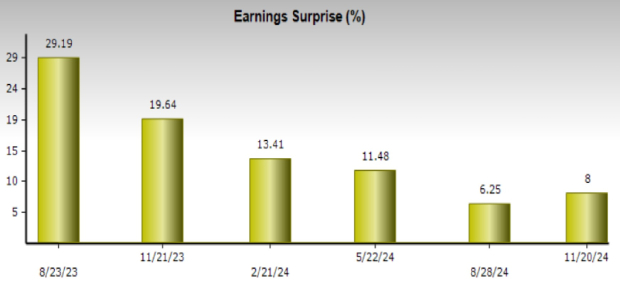

Analysts predict that NVIDIA’s shares will continue to grow, bolstered by solid earnings from the high demand for Blackwell chips, reduced concerns over DeepSeek, and strong GPU dominance. Therefore, NVDA stock presents an appealing buy opportunity at this time. Furthermore, NVIDIA boasts a low debt-to-equity ratio of 12.8%, significantly lower than the Semiconductor – General industry’s average of 20.1%, which mitigates investment risk.

Image Source: Zacks Investment Research

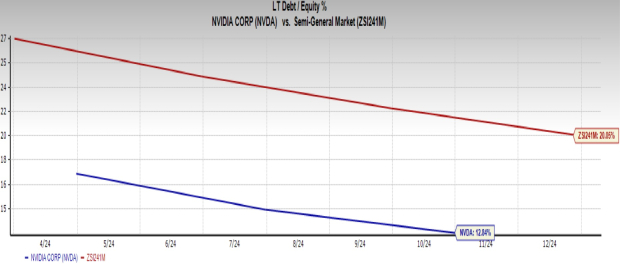

Additionally, NVIDIA’s stock remains reasonably priced, trading at a price/earnings ratio of 30.9X forward earnings compared to the industry’s 36.06.

Image Source: Zacks Investment Research

As a result, NVIDIA holds a Zacks Rank of #2 (Buy). You can find the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Access Zacks’ Buys and Sells for Only $1

We’re sincere about this offer.

Years ago, we surprised our members by providing them with a 30-day access to all our picks for just $1. No further obligations.

Thousands have seized this opportunity, while many others hesitated, thinking it was too good to be true. We genuinely want you to familiarize yourself with our portfolio services, which have successfully closed 256 positions with double- and triple-digit gains in 2024 alone.

Want the latest recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free.

Intel Corporation (INTC) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.