“`html

Apple’s Earnings and Growth Challenges

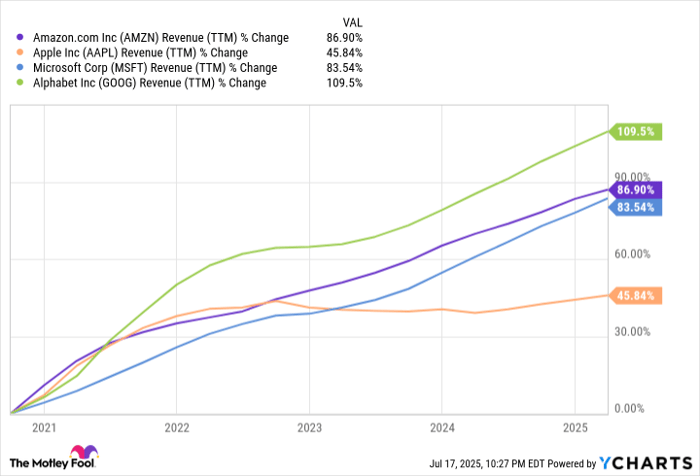

Apple Inc. (NASDAQ: AAPL) is set to report its second-quarter earnings on July 31, 2025. The company’s stock has seen a 14% decline year-to-date, primarily due to slowing growth and increasing tariffs that have affected sales in the U.S. and China. iPhone revenue, which comprises half of Apple’s total revenue, has not grown since 2021, averaging only a 46% increase in the past five years, in stark contrast to peers like Microsoft (83.5%), Amazon (86.9%), and Alphabet (109.5%).

Challenges in Key Markets

In China, Apple’s revenue has declined since March 2022, impacted by domestic competitors and regulatory pressures. However, there are signs of recovery, with an estimated 8% growth in Q2 2025. The company is also lagging in markets filled with innovations like AI and cloud computing, further complicating its growth prospects amidst regulatory challenges and trade tensions, particularly between the U.S. and China.

Market Valuation and Future Outlook

Currently, Apple’s stock trades at a price-to-earnings ratio of 33, significantly above its historical average and higher than many competitors experiencing faster growth. Analysts express skepticism about finding new avenues for significant revenue growth, highlighting that investors should consider selling before the upcoming earnings report.

“`