Target Stock Price Drops: Analysts Consider Buy Opportunity

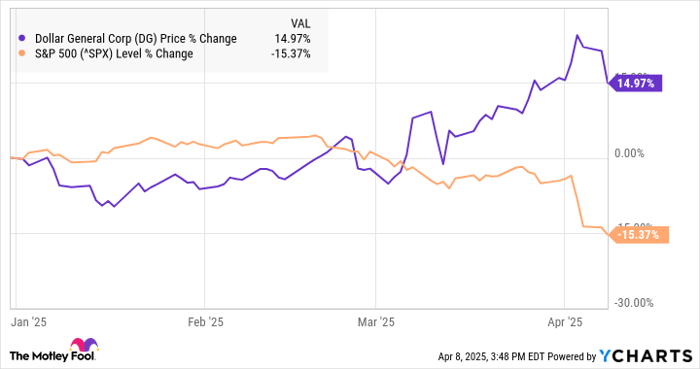

In light of rising tariffs affecting consumer prices, Target’s TGT Stock recently hit multi-year lows, falling below $90 a share, the lowest since the COVID-19 pandemic began.

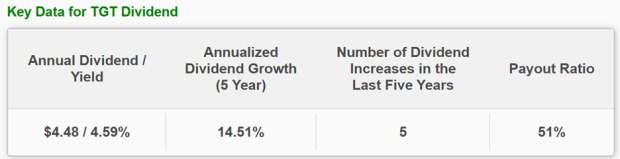

With a 47% decrease from its 52-week high of $173, Target Stock is attracting attention as a potential buy-the-dip asset, offering an annual dividend yield of 4.59%.

Image Source: Zacks Investment Research

Target’s Valuation Hits Decade-Lows

Sales Outlook & Price-to-Sales Valuation

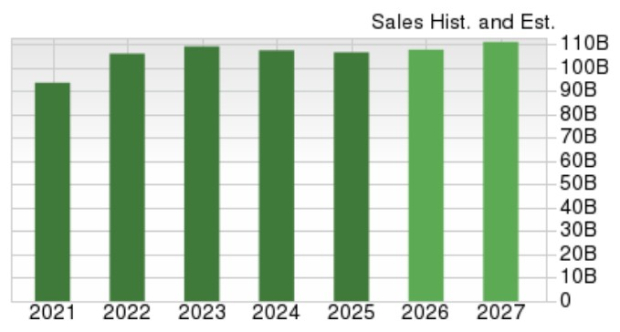

Target’s sales growth has decelerated in recent years; however, analysts forecast a 1% increase in revenue for fiscal year 2026, followed by a 3% rise in FY27, reaching $110.71 billion. This marginal growth translates to only a 1% improvement compared to the past five years, with FY23 sales recorded at $109.12 billion.

Image Source: Zacks Investment Research

In a positive move, Target has teamed up with Shopify SHOP to boost its third-party marketplace and online sales, aiming to enhance competition against industry leaders Walmart WMT and Amazon AMZN.

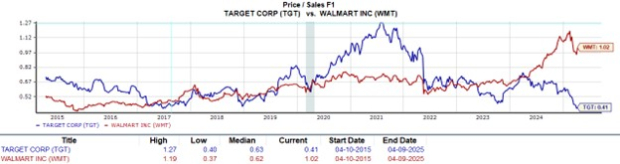

Currently, Target trades at a decade-low price-to-forward sales ratio of 0.4X, significantly below the ideal benchmark of 2X. In comparison, the Zacks Retail-Discount Stores Industry averages 0.5X, while Walmart is at 1X.

Image Source: Zacks Investment Research

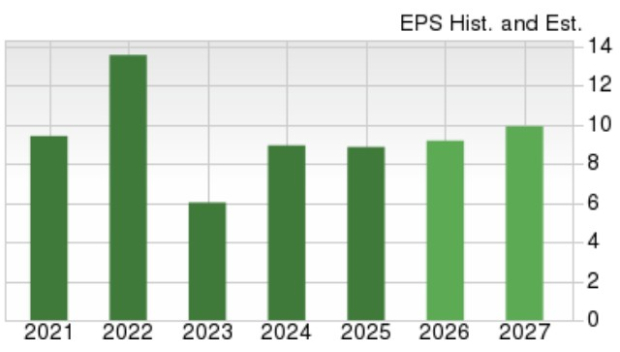

P/E Valuation & Earnings Per Share Prognosis

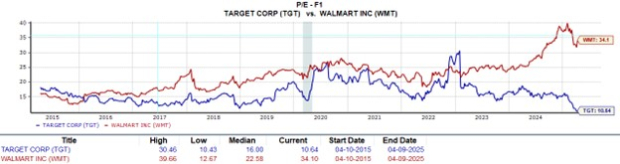

Target Stock is also considered undervalued as it currently trades at a forward price-to-earnings (P/E) ratio of 10.6X, contrasting sharply with the industry average of 19.8X and Walmart’s 34.1X. This valuation marks a decade low for TGT, presenting a notable discount compared to its peak of 30.4X and a median of 16X.

Image Source: Zacks Investment Research

Despite facing challenges, Target’s annual earnings are predicted to increase by over 1% in FY26, with forecasts suggesting a further rise of 7% in FY27 to $9.62 per share. While the company has struggled with inventory and shrinkage issues recently, FY27 EPS expectations would still exhibit a 59% increase over the past five years, with an EPS figure of $6.02 for FY23.

Image Source: Zacks Investment Research

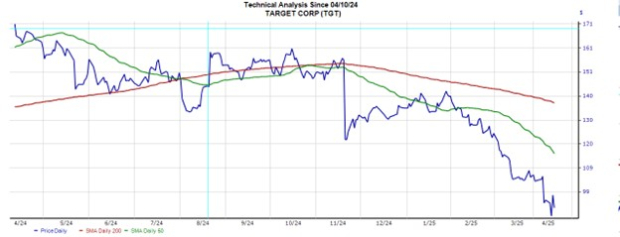

Technical Analysis for Target Stock

For technical analysts, a sustained rebound in Target’s Stock would require it to reclaim its 50-day Simple Moving Average (SMA), currently positioned at $113, as depicted in the chart below.

Image Source: Zacks Investment Research

Target’s Strong Dividend History

While investors await a turnaround, Target remains steadfast as a dividend king, having raised its dividend for over 54 years. The company’s 51% payout ratio indicates sustainability and potential for future increases. Additionally, Target’s annual dividend yield surpasses that of Walmart’s 1.05%, the industry average of 1.23%, and the S&P 500 benchmark of 1.35%.

Image Source: Zacks Investment Research

Conclusion and Perspectives

Currently, Target holds a Zacks Rank #3 (Hold). This situation seems attractive for long-term investors, particularly given Target’s strong dividend background. However, prevailing tariff concerns could affect the stock market and consumers. Investors may wish to wait for more favorable buying situations to increase their positions in TGT or assist existing shareholders in reducing their cost basis.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.9% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Target Corporation (TGT): Free Stock Analysis report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

Walmart Inc. (WMT): Free Stock Analysis report.

Shopify Inc. (SHOP): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.