Market Reactions: Palantir and Vertiv Stocks Dip Amidst Policy Concerns

Broader market indexes struggled on Thursday, following Walmart’s WMT cautious forecast. This prompted investors to reevaluate the impact of President Trump’s tariffs and other policy shifts.

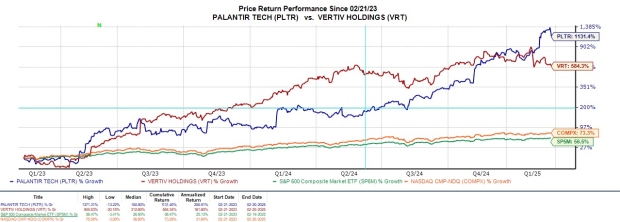

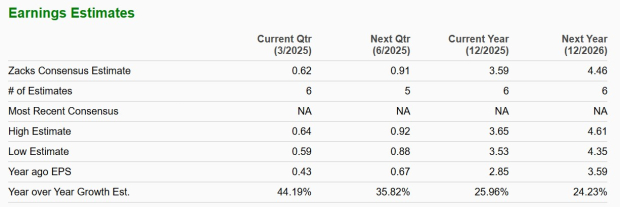

Two stocks that faced declines and might attract investor interest are Palantir Technologies PLTR and Vertiv Holdings VRT. Both are seen as potential ‘buy-the-dip’ opportunities; Palantir shares have risen over +1,100% in the last two years, while Vertiv stock has climbed over +500%.

Image Source: Zacks Investment Research

PLTR Faces Pressure Following Defense Budget Cuts

On Thursday, Palantir’s stock fell 5% to $106 per share, a decline that followed last week’s announcement from the Trump administration regarding planned defense spending cuts, urging both Russia and China to reduce their military budgets as well.

Palantir provides software solutions to intelligence agencies, with the U.S. government as its main client. Although its technology aids in counterterrorism, advancements in machine learning and artificial intelligence have expanded its customer reach.

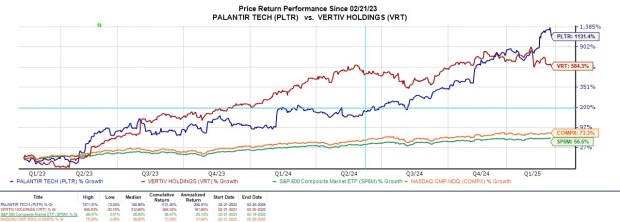

Optimism surrounds the company, especially after it surpassed Q4 expectations earlier this month. Earnings estimates for fiscal 2025 and FY26 have increased, with EPS estimates rising by 12% and 18% respectively over the past month.

Image Source: Zacks Investment Research

Expectations remain high for Palantir, forecasting strong double-digit growth moving forward. The company currently holds a “B” and “A” in Zacks Style Scores for Growth and Momentum. However, Palantir needs to justify its high valuation, as it holds an “F” in Value Score.

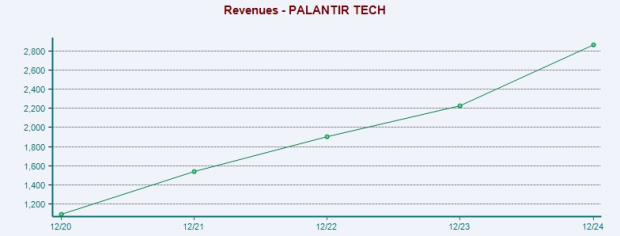

Since its public offering in 2020, Palantir has achieved profitability, and it reported $2.87 billion in sales last year. Projections indicate a 31% increase for FY25, estimating sales to reach $3.76 billion.

Image Source: Zacks Investment Research

Vertiv Experiences Similar Declines

Vertiv also saw a 3% decline on Thursday, dropping to $104. Unlike Palantir, Vertiv is not directly affected by Trump’s policies. The company, which went public in 2020, specializes in digital infrastructure and continuity solutions, covering hardware, software, and analytic services.

Like Palantir, Vertiv surpassed Q4 expectations earlier this month. Its sales are projected to grow by 15% in FY25 and FY26, closing in on $10 billion. Notably, Vertiv has reported a net income of $495.8 million in 2024, with EPS growth exceeding 20% expected for FY25 and FY26.

Image Source: Zacks Investment Research

Although Vertiv carries a “D” in Zacks Style Score for Value, its forward earnings multiple is a reasonable 30.1X, aligning closely with its industry average but above the S&P 500’s 23.2X. For Growth and Momentum, VRT achieved an “A” and “C” Style Score respectively.

Image Source: Zacks Investment Research

Conclusion

Given their Value Scores, both Palantir and Vertiv stocks might appeal to risk-tolerant investors seeking potential high returns. Current market conditions suggest these stocks could be attractive buys as both companies have performed remarkably well in recent years.

Five Stocks Positioned for Significant Gains

Experts at Zacks have identified five stocks as top picks for the potential to double in 2024. Historical recommendations have achieved impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently under Wall Street’s radar, presenting a great opportunity for early investment.

Discover These 5 Stocks with High Potential >>

Free Stock Analysis Report: Vertiv Holdings Co. (VRT)

Free Stock Analysis Report: Palantir Technologies Inc. (PLTR)

Free Stock Analysis Report: Walmart Inc. (WMT)

Read this article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.