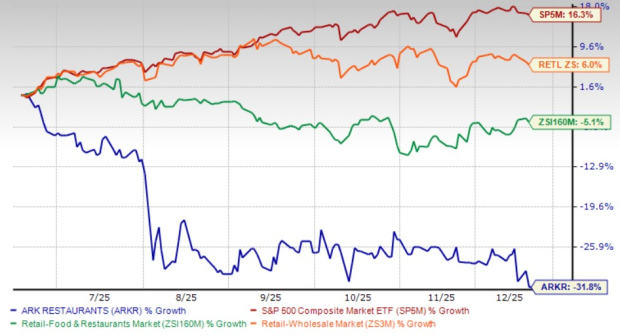

Ark Restaurants Corp. (ARKR) has seen its stock decline by 31.8% over the past six months, significantly underperforming the retail restaurant industry, which declined by 5.1%. The company’s fourth-quarter fiscal 2025 results, released on Monday, revealed weaker sales performance and ongoing losses, attributed to reduced traffic at key locations and challenges linked to legal disputes at Bryant Park. In contrast, corporate events are gradually returning, providing some positive cash flow, particularly in Las Vegas and select New York properties.

Management highlighted increased operational efficiency and cash flow at venues such as the New York-New York Hotel & Casino and Robert in New York as positives. However, higher legal costs and weakened demand in markets like Washington, D.C., and Florida continue to pose challenges. Despite these pressures, Ark Restaurants maintains a robust balance sheet and is focusing on stabilizing operations while preparing for future growth opportunities, especially related to potential developments at the Meadowlands Racetrack.

Currently, Ark Restaurants operates 17 restaurants and bars, as well as 16 fast food concepts, across various states including New York, Las Vegas, and Florida. The firm’s trailing 12-month EV/Sales ratio stands at 0.08X, significantly lower than the industry’s average of 4.17X, indicating potential valuation concerns amidst ongoing operations and legal uncertainties.