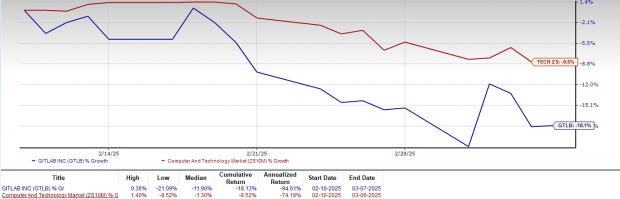

GitLab’s Recent Share Performance and Future Outlook

GitLab (GTLB) shares have decreased by 18.1% over the past month, trailing behind the broader Zacks Computer & Technology sector, which fell by 8.5%. However, following the company’s fourth-quarter fiscal 2025 results released on Monday, GitLab shares have since gained 3.6%.

Analysts attribute this slight rebound to GitLab’s comprehensive DevSecOps platform, including offerings such as GitLab Ultimate, Dedicated, and GitLab Duo. These solutions have significantly contributed to customer adoption and the expansion of existing client relationships.

Click here for more details on GTLB’s fourth-quarter fiscal 2025 results.

GitLab’s Performance Compared to Its Sector

Image Source: Zacks Investment Research

In the fourth quarter of fiscal 2025, GitLab reported an increase in customers generating over $5,000 in Annual Recurring Revenues (ARR) to 9,893, marking a 15% year-over-year increase. Customers with ARR exceeding $100,000 grew to 1,229, showing a 29% year-over-year rise. This trend reflects GitLab’s success in attracting and retaining large enterprise clients.

Strategic Partnerships Bolster GitLab’s Position

GitLab is seeing benefits from its extensive partner network, including major cloud platforms like Alphabet’s (GOOGL) Google Cloud and Amazon’s (AMZN) AWS, along with Zscaler (ZS). These alliances are essential for expanding GitLab’s reach among large enterprises.

Recently, GitLab collaborated with AWS to launch an AI-driven solution designed to enhance both software development and security. By integrating GitLab Duo with Amazon Q’s autonomous agents, this partnership aims to streamline workflows, speed up code delivery, and improve security across the development lifecycle.

Moreover, the integration of GitLab’s DevSecOps platform with Google Cloud services has improved developer productivity, simplifying authentication and application deployment while also enhancing the overall developer experience.

Additionally, in the fourth quarter of fiscal 2025, GitLab teamed up with Zscaler to enhance security within DevSecOps by integrating Zscaler’s cloud security solutions with its development platform. This collaboration aids companies in elevating software security and compliance throughout their development processes.

AI-Driven Enhancements to GitLab’s Product Line

GitLab is capitalizing on artificial intelligence (AI) by rolling out AI-powered tools, including GitLab Duo Pro and Duo Enterprise, which aim to improve developer productivity through features like code generation and assistance. This move strengthens GitLab’s reputation within the developer community.

In the fiscal fourth quarter, GitLab Duo, particularly the Duo Enterprise version, experienced robust performance as clients adopted AI innovations throughout the development lifecycle. The tool’s capabilities were integrated into the workflows of several large customers, enhancing their DevSecOps activities.

Furthermore, GitLab announced the entry of its Duo Workflow product into private beta during the fourth quarter of 2024. This initiative focuses on AI-enhanced software development, aiming to leverage Generative AI to streamline the development process and attract AI-oriented developers and companies.

GitLab’s Positive Q1 2026 Forecast

The growing clientele and leading position in the DevSecOps sector contribute positively to GitLab’s growth potential. For the first quarter of fiscal 2026, GTLB projects revenues between $212 million and $213 million, reflecting a year-over-year growth rate of 25-26%.

The Zacks Consensus Estimate for first-quarter fiscal 2026 revenues stands at $212.7 million, indicating a projected 25.72% increase from the previous year. Non-GAAP fiscal first-quarter earnings per share are anticipated to fall between 14 and 15 cents. Meanwhile, the consensus estimate for earnings remains at 14 cents per share, unchanged over the last 30 days, signaling a substantial year-over-year increase of 366.67%.

GitLab Inc. Price and Consensus

GitLab Inc. price-consensus-chart | GitLab Inc. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Competitive Pressures for GitLab in DevSecOps and AI Markets

Despite GitLab’s strong performance, the company faces significant competition in the DevSecOps arena, where rivals are consistently innovating. This dynamic environment presents challenges for GitLab to uphold its leadership while adapting to evolving customer demands.

One of GitLab’s primary competitors, Microsoft, consolidates its position through the smooth integration of GitHub and Azure DevOps. By continuously enhancing its DevSecOps capabilities, Microsoft has emerged as a formidable competitor, complicating GitLab’s efforts to distinguish itself in the market.

Additionally, the rapid advancement of AI technology poses challenges for GitLab as it strives to stay ahead by incorporating autonomous AI features across its platform. Failure to innovate within the AI space could undermine its competitive position in an increasingly crowded market.

Current Valuation of GTLB Stock

It’s worth noting that GTLB shares currently carry a premium valuation, reflected in a Value Score of F, suggesting that the stock may be overvalued. GitLab’s forward 12-month price/sales (P/S) ratio stands at 9.94X, outpacing the Zacks Computer and Technology sector average of 5.91X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Investment Considerations for GTLB Stock

GitLab’s robust growth, AI-driven DevSecOps platform, and solid partnerships position it prominently in the DevOps industry. However, the increasing competition and pressure on near-term profitability present hurdles that investors should consider.

Given its stretched valuation and modest growth outlook, it may be prudent for investors to approach GitLab stock with caution, evaluating the associated risks before making investment decisions.

GitLab’s Growth Score Renders It Unappealing for Investors

GitLab Inc. currently holds a Zacks Rank of #4 (Sell), suggesting that investors should refrain from adding this stock to their portfolios at this time.

For those interested in the best investment opportunities, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Discover Zacks’ Top 10 Stocks for 2025

Don’t miss the chance to invest early in our top 10 stock selections for the year 2025. This portfolio, curated by Zacks Director of Research Sheraz Mian, has demonstrated remarkable success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks have achieved a return of +2,112.6%, which is more than quadruple the S&P 500’s +475.6%. After analyzing 4,400 companies covered by the Zacks Rank, Sheraz has identified the top 10 firms to buy and hold for the upcoming year. You can be among the first to explore these newly released stocks with significant potential for growth.

If you’re looking for the latest investment recommendations from Zacks Investment Research, you can currently download the report on the 7 Best Stocks for the Next 30 Days. Click to access this complimentary report.

Here are some other companies with free stock analysis reports:

- Amazon.com, Inc. (AMZN): Free Stock Analysis report

- Alphabet Inc. (GOOGL): Free Stock Analysis report

- Zscaler, Inc. (ZS): Free Stock Analysis report

- GitLab Inc. (GTLB): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.