Alibaba Set to Report Q4 Fiscal 2025 Results on May 15

Alibaba Group Holding Limited (BABA) is set to report its fourth-quarter fiscal 2025 results on May 15.

Quarterly Revenue and Earnings Estimates

The Zacks Consensus Estimate anticipates revenues of $33.08 billion for the fiscal fourth quarter, reflecting a 7.64% increase from the previous year. Earnings are projected at $1.48 per share, which represents a 5.71% rise from the same quarter last year.

Image Source: Zacks Investment Research

Earnings Surprise History

Alibaba has experienced a mixed earnings surprise history. In the last quarter, it posted a negative earnings surprise of 4.87%. Over the last four quarters, the company has beaten the Zacks Consensus Estimate twice and missed it twice, with an average surprise of 1.47%.

Alibaba Group Holding Limited Price and EPS Surprise

Alibaba Group Holding Limited price-eps-surprise | Alibaba Group Holding Limited Quote

Earnings Whispers for BABA

The current model does not indicate a definitive earnings beat for Alibaba this time. A positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) generally increases the likelihood of an earnings beat, which is currently not applicable. As it stands, BABA has an earnings ESP of 0.00% and holds a Zacks Rank #2.

Key Considerations Ahead of Q4 Results

Alibaba is expected to report strong results, buoyed by momentum from an impressive third quarter. Investors may want to position themselves ahead of what seems to be another solid quarter, driven by advances in AI initiatives and cloud computing growth.

The company’s focus on “user first, AI-driven” strategies has shown significant progress. Customer management revenues at Taobao and Tmall grew by 9% in the third quarter, while Cloud revenue surged back into double digits at 13%. AI-related product revenues have achieved triple-digit growth for six consecutive quarters.

Recent strategic moves include a sizable RMB 380 billion ($53 billion) investment in cloud computing and AI over the next three years—significantly more than what Alibaba spent on AI and cloud initiatives in the past decade. This commitment underscores the company’s objective to maintain its leadership in the global AI landscape.

Alibaba Cloud also expanded internationally, adding new cloud regions in Mexico and Thailand, bringing its total to 87 availability zones across 29 regions. This expansion positions Alibaba to meet increasing cloud demand in emerging markets while diversifying its revenue streams beyond China.

Additionally, the company’s PolarDB achieved a world record in the TPC-C benchmark, processing 2.055 billion transactions per minute and reducing cost per transaction by almost 40%. This advancement demonstrates Alibaba’s ability to provide high-performance solutions at reduced costs, attracting more enterprise clients to its cloud platform.

AI innovation remains a focal point, with Alibaba’s QWQ-32B model gaining popularity, recording over 80,000 downloads within a single week. Partnerships with BMW, Honor, and Zeekr are expanding Alibaba’s reach into the automotive and smartphone sectors, creating additional revenue opportunities beyond traditional cloud services.

In international e-commerce, Alibaba’s management expects Artificial Intelligence Development Cloud (AIDC) to achieve its first profitable quarter in the upcoming fiscal year. This anticipated profitability should enhance investor confidence in Alibaba’s global growth initiatives.

With BABA currently trading at attractive valuations relative to its growth potential and AI leadership, the upcoming earnings report presents a viable entry point for investors looking to tap into China’s technology sector and the expanding global AI market.

BABA Price Performance & Stock Valuation

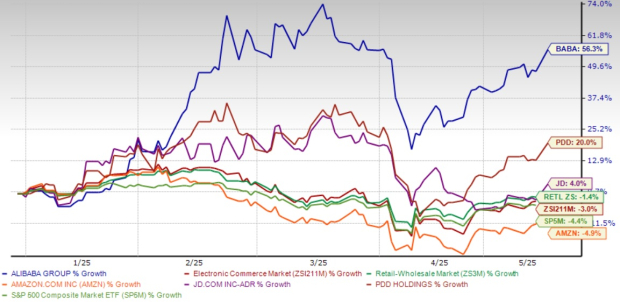

Shares of Alibaba have risen by 56.3% year-to-date, outpacing the Zacks Retail-Wholesale sector and the S&P 500, which have seen declines of 3%, 1.4%, and 4.4%, respectively.

BABA faces significant competition from Amazon (AMZN), JD.com (JD), and PDD Holdings (PDD). In the same period, JD has gained 4%, and PDD has increased by 20%, while AMZN has fallen by 4.9%.

Year-to-date Price Performance

Image Source: Zacks Investment Research

It is crucial to evaluate whether BABA’s current valuation aligns with its long-term growth potential. Currently, BABA trades at a forward 12-month P/E ratio of 11.91X, compared to the industry average of 21.24X. This disparity presents an attractive buying opportunity for investors ahead of the fiscal fourth-quarter results.

BABA’s P/E F12M Ratio Depicts Discounted Valuation

Image Source: Zacks Investment Research

Alibaba: A Strong Buy Ahead of Q4 Fiscal Earnings

Investment Thesis

Alibaba showcases an attractive buying opportunity before the upcoming fourth-quarter fiscal 2025 earnings report. Currently, shares are trading at a notable discount, while the company reports strong growth fundamentals. Alibaba’s RMB 380 billion investment in artificial intelligence and cloud infrastructure places it at the forefront of technological advancements. Additionally, partnerships with BMW, Honor, and Zeekr are broadening its AI ecosystem beyond traditional limits. Cloud revenue is increasing steadily, with AI-related products demonstrating triple-digit growth over the past six quarters. Furthermore, Alibaba’s international e-commerce segment is nearing profitability, diversifying its revenue streams. The introduction of innovative models like the QWQ-32B and the impressive performance of PolarDB exemplify the company’s technological leadership. Despite significant competition, Alibaba’s discounted valuation does not adequately reflect its strong market position and remarkable growth potential within the booming AI and cloud industries.

Conclusion

Alibaba represents a unique opportunity at its current valuations. The company’s significant investments in AI and its expanding global cloud presence are poised to fuel considerable growth. With triple-digit AI revenue growth and strategic collaborations, numerous catalysts exist before the fourth-quarter results are unveiled. As international e-commerce edges closer to profitability and cloud infrastructure expands, investors should consider acting promptly to fully leverage Alibaba’s transformative potential in the AI landscape.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.