FedEx Corporation (FDX) announced a 5.1% increase in its quarterly dividend, raising it from $1.38 to $1.45 per share, effective July 8, 2025. This marks the fifth consecutive year of dividend growth for the company.

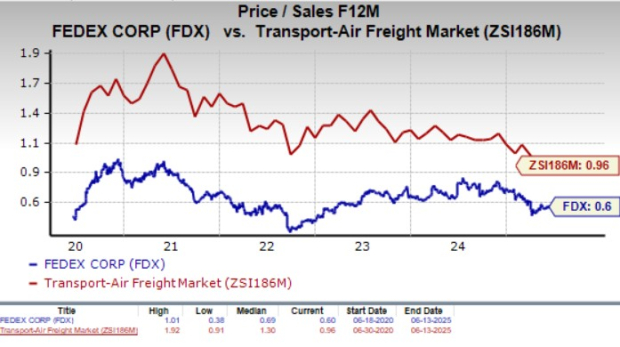

In fiscal 2025, FedEx has executed $2.52 billion in share buybacks within the first nine months, surpassing the total for fiscal 2024. The company’s current dividend yield is 2.46%, significantly lower than the Zacks Transportation – Air Freight and Cargo industry’s 4.79% yield. However, shareholders expressed concerns over the company’s recent revenue forecasts, which project flat or declining revenue in a challenging economic environment.

Overall, FedEx’s operational costs rose by 2% year-over-year due to higher business optimization and labor expenses. This financial pressure amidst geopolitical uncertainty and persistent inflation has led analysts to decrease earnings estimates for the company, reflecting a negative sentiment in the market.