Market Shifts: Tesla Faces Challenges as Lucid Gains Ground

President Trump’s tariffs have significantly impacted the electric vehicle (EV) market. Tesla, Inc. (TSLA) has experienced increased volatility in its shares, coinciding with mounting criticism directed at CEO Elon Musk. Meanwhile, Lucid Group, Inc. (LCID) appears to be capitalizing on Tesla’s challenges, casting Lucid as a promising investment opportunity.

Tesla Struggles with Sales and Reputation

Tesla shares have dropped 45% from their mid-December peak of $488.54. Despite this downturn, Musk remains the world’s wealthiest individual. However, backlash stemming from his association with Trump and far-right politics in Europe has tarnished Tesla’s brand image.

As a result, Tesla reported a 13% decline in vehicle sales in the January-March quarter, marking its poorest performance since 2022. Contributing factors include outdated vehicle models and heightened competition from other manufacturers. Despite offering generous incentives, including zero financing options and significant discounts, Tesla struggled to attract buyers.

Vehicle sales in Europe have declined, and the National Highway Traffic Safety Administration has recalled the Cybertruck in the United States. Furthermore, prospective customers are holding back on purchasing the Model Y in anticipation of an upgraded version expected to launch later this year.

Lucid Attracts Tesla Owners Seeking Alternatives

Amidst Tesla’s difficulties, current owners and potential buyers are exploring alternatives, leading many to consider Lucid. Recently, Lucid has seen a notable surge in orders, with nearly 50% of new EV orders coming from former Tesla customers.

As a smaller entity, Lucid stands to benefit greatly from any decline in Tesla’s demand. If Tesla were to lose just 1% of its 1.8 million vehicles sold in 2024, that could translate to 18,000 buyers looking elsewhere, a market Lucid could potentially capture, especially given its sales of only 10,000 vehicles last year.

Lucid’s goal for 2025 is to sell 20,000 vehicles, doubling its previous year’s sales. This target seems achievable due to Lucid’s procurement of parts mainly from the U.S., insulating it from the new wave of tariffs affecting others in the industry.

Should Investors Consider Lucid Stock Now?

As Lucid appears poised to grow amidst Tesla’s faltering image, maintaining an investment in LCID stock could be a prudent decision. Analysts share optimism for Lucid’s prospects, increasing the average short-term price target for LCID by 11.7%, raising it to $2.68 from $2.40. The highest target has been set at $5, suggesting an upside potential of 108.3%.

Image Source: Zacks Investment Research

Still, challenges linger for Lucid. Despite achieving $807.8 million in revenues in 2024, the company reported a gross profit loss of $923.1 million. For the quarter ending December 31, Lucid incurred a net loss of $636.9 million, resulting in a loss of 22 cents per share against revenues of $234.5 million.

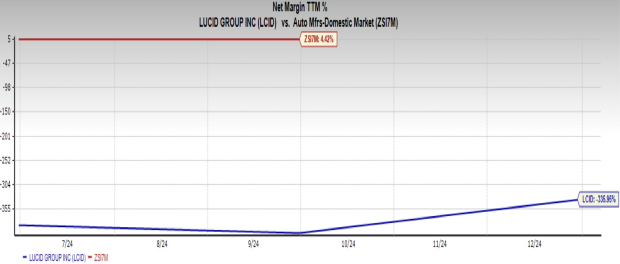

Lucid’s net profit margin stands at negative 335.9%, while the average margin for the domestic automotive industry is 4.4%. This indicates that current revenues from car sales do not cover overhead costs. Increasing production is essential for profitability; therefore, potential investors should proceed with caution before investing in LCID stock.

Image Source: Zacks Investment Research

To capture a broader market, Lucid needs to develop more affordable EVs instead of relying solely on its $79,900 Gravity SUV, which appeals to a niche market. Recent first-quarter deliveries have surpassed estimates, showing positive growth compared to last year. Currently, Lucid holds a Zacks Rank #3 (Hold), and investors can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 outstanding stocks from a total of 220 Zacks Rank #1 Strong Buys, which they believe are “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market by more than double with an average annual gain of +23.9%. It’s advisable to consider these top 7 stocks quickly.

see them now >>

Want the latest recommendations from Zacks Investment Research? You can download the list of the 7 Best Stocks for the Next 30 Days. Click for the free report.

Tesla, Inc. (TSLA): Free Stock Analysis report

Lucid Group, Inc. (LCID): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.