Nvidia Reports Strong Q1 Results, Faces Export Challenges

Nvidia (NASDAQ: NVDA) remains a key player in artificial intelligence (AI) investment, primarily due to its GPUs used in data centers for AI workloads. Nvidia’s strong performance indicates ongoing momentum in AI investments.

The company recently released its first-quarter fiscal year 2026 results (ending April 28), showing impressive growth. Investors need to watch potential challenges ahead. Is it still a buy?

Impact of U.S. Government Export Restrictions

Nvidia dominates the data center GPU market, with over 90% market share. This position benefits investors. In Q1, Nvidia’s revenue surged 69% year-over-year to $44 billion. However, growth is projected to slow slightly in the upcoming quarter, with revenue expected around $45 billion, reflecting a 50% year-over-year increase.

Government restrictions contribute to this slowdown. On April 9, Nvidia was informed it needed a license to sell H20 chips, leading to a $4.5 billion charge for excess inventory and a missed $2.5 billion in revenue for Q1. Prior to these restrictions, Nvidia sold $4.6 billion in H20 chips and anticipated $8 billion in sales for Q2.

If the restrictions did not exist, Q2 growth could have reached around $53 billion, equating to a 77% increase. Adding back the $2.5 billion loss in Q1 suggests a growth rate of 79%. In comparison, Q4 growth was 78%, signaling strong GPU spending continues from clients.

This data underscores a robust outlook for Nvidia, hindered mainly by government restrictions.

The market reacted positively to Nvidia’s earnings report, even without the dramatic increases typically seen in the past. This raises the question: does this make Nvidia a buy now?

Nvidia’s Valuation and Investment Outlook

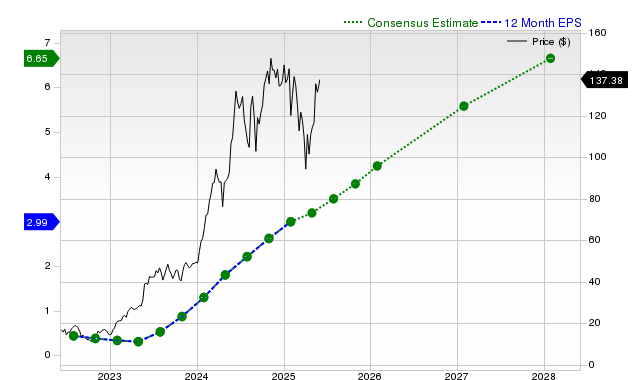

Due to one-time charges from write-offs, Nvidia’s trailing earnings per share (EPS) may not reflect true performance, affecting the trailing price-to-earnings (P/E) ratio. Consequently, analysts are focusing on Nvidia’s forward P/E for valuation.

While Nvidia’s stock trades at a forward P/E of 33, it continues to grow rapidly. Few companies mirror its growth consistency.

Despite U.S. export challenges, Nvidia’s core operations remain strong, with sustained demand for GPUs. The stock appears to be a solid investment, particularly for those willing to hold for three to five years, given robust AI trends favoring Nvidia.

Is Nvidia a Good Investment Now?

Before investing in Nvidia, consider the following:

The Motley Fool analyst team has identified other lucrative opportunities, mentioning ten stocks they believe are strong buys, excluding Nvidia.

For example, those who invested $1,000 in Netflix after its recommendation would have seen their investment grow significantly. Similarly, Nvidia has shown remarkable past returns.

However, the Stock Advisor‘s total average return significantly outperforms the market, suggesting investors assess multiple avenues before deciding.

*These returns are as of May 19, 2025.

Keithen Drury holds positions in Nvidia. The Motley Fool also has positions in and recommends Nvidia.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.