“`html

Palantir Technologies Set to Report Q1 2025 Earnings Soon

Palantir Technologies Inc. (PLTR) will report its first-quarter 2025 results on May 5, after the market closes.

Financial Expectations and Growth Projections

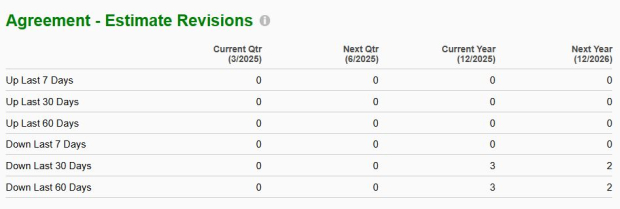

The Zacks Consensus Estimate for earnings in this upcoming quarter stands at 13 cents, representing a 62.5% growth from the same quarter last year. Additionally, the estimated total revenue is $862.9 million, reflecting a 36% year-over-year increase. So far, analyst estimates have remained unchanged without any recent revisions.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Palantir has demonstrated a notable earnings surprise history, exceeding the Zacks Consensus Estimate in three of the last four quarters and matching it once, with an average earnings surprise of 12.7%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Challenges for Q1 Earnings Prediction

Despite the positive historical performance, our model indicates a lesser likelihood of an earnings beat for PLTR this quarter. Typically, a positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) improves the chances of a favorable earnings outcome. However, PLTR currently has an earnings ESP of 0.00% and a Zacks Rank of #5 (Strong Sell).

Business Performance Indicators for Q1

In the upcoming quarter, we expect a notable year-over-year increase in the company’s revenues, driven by strong demand from both new and existing clients across the Government and Commercial sectors.

The consensus estimate for Government revenue is $454 million, reflecting a 35.5% year-over-year growth, while the Commercial revenue estimate stands at $399 million, indicating a 33.4% year-over-year increase.

Valuation Concerns for PLTR Stock

Palantir shares have risen 52% year-to-date, significantly outpacing the 6% decline in its industry and the broader S&P 500. The demand for this AI-focused stock remains strong among investors looking to capitalize on growth opportunities.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conversely, major technology stocks like Nvidia (NVDA) and Oracle (ORCL) have underperformed, with Nvidia down 19% year-to-date and Oracle down 15%.

Considering its current valuation metrics, Palantir appears expensive. The trailing 12-month EV-to-EBITDA multiple is 1491.5X, significantly higher than the industry average of 12.35X. Furthermore, the forward 12-month Price/Earnings ratio for PLTR is 191.93X, compared to the industry’s 34.12X.

Investment Outlook for PLTR

Although PLTR is projected to report year-over-year growth in earnings and revenues for the first quarter, its high valuation relative to peers raises concerns. Recent trends among analysts and the company’s weak earnings prediction model suggest a cautious outlook for the stock. Despite the strength of PLTR’s government and commercial sectors, high valuations leave little margin for error. Given the significant price rally this year, there is a heightened risk of a pullback if earnings expectations are not met. Investors might consider taking profits from PLTR shares amid potential market volatility.

Currently, PLTR holds a Zacks Rank of #5 (Strong Sell).

“`