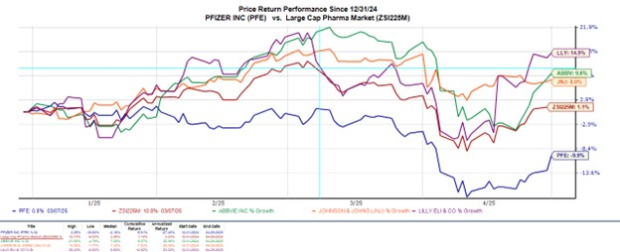

Pfizer Surprises with Strong Q1 Earnings, Yet Stock Faces Challenges

Pfizer PFE experienced a +3% rise in shares during Tuesday’s trading session after exceeding Q1 earnings expectations.

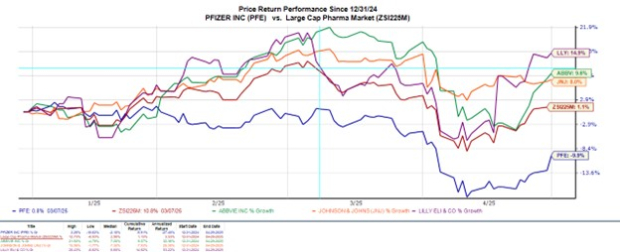

Despite this positive performance, Pfizer’s stock has declined by 10% year-to-date, failing to provide the defensive advantages seen by some competitors, including AbbVie ABBV, Eli Lilly LLY, and Johnson & Johnson JNJ.

Nevertheless, investors might find opportunities as Pfizer shares trade near multi-year lows of around $20.

Image Source: Zacks Investment Research

Pfizer’s Q1 Financial Performance

In what Pfizer described as a dynamic operating environment, the company posted earnings of $0.92 per share for Q1, surpassing EPS expectations of $0.64 by 43%. This also marked an increase from the prior year’s $0.82 per share. Pfizer emphasized its commitment to achieving its net cost savings goals, despite declining revenue from COVID-related products and disappointing clinical outcomes for its weight loss drug, which is intended to compete with offerings from Eli Lilly and Novo Nordisk NVO.

Conversely, Pfizer’s Q1 sales totaled $13.71 billion, falling short of estimates of $13.83 billion and down from $14.87 billion a year earlier. Nonetheless, it is important to note that Pfizer has exceeded the Zacks EPS Consensus for 11 consecutive quarters, with an impressive average earnings surprise of 43.48% across its last four reports.

Image Source: Zacks Investment Research

Full-Year Guidance Maintained

Pfizer has reaffirmed its fiscal 2025 guidance, predicting revenues between $61 billion and $64 billion, with current Zacks projections at $63.48 billion. The company also expects adjusted EPS for FY25 to be in the range of $2.80-$3.00, while the Zacks Consensus stands at $2.99.

Valuation and Investor Appeal

For long-term investors, Pfizer’s stock appears appealing as it is trading near a decade-low price-to-forward earnings ratio of 7.7X, significantly below the high of 20.1X during this timeframe. Additionally, Pfizer trades at a discount compared to the S&P 500’s forward earnings multiple of 21.3X and the Zacks industry average of 16.4X.

Image Source: Zacks Investment Research

Dividend Highlights

Currently, Pfizer’s annual dividend yield stands at 7.46%, significantly higher than the industry average of 2.51% and the benchmark’s 1.33%. Although Pfizer lost its dividend aristocrat status during the 2008 financial crisis, it has since increased its dividend for 16 consecutive years.

Image Source: Zacks Investment Research

Conclusion and Outlook

Following its Q1 report, Pfizer’s stock holds a Zacks Rank #2 (Buy). Recent earnings estimate revisions for FY25 and FY26 have trended upward over the last month. This momentum could continue, as Pfizer’s recent EPS results exceeded expectations while demonstrating cost-saving initiatives.

Such developments could strengthen Pfizer’s current valuation and potentially lead to further stock appreciation, especially as it offers compelling long-term value for shareholders alongside its high dividend yield.