NVIDIA Stock Rises as Major Clients Boost AI Spending Outlook

NVIDIA Corporation NVDA saw a near 2.5% increase on Thursday, spurred by fresh optimism from key clients Meta Platforms, Inc. META and Microsoft Corporation MSFT. Both companies reaffirmed, and in Meta’s case raised, their capital expenditure commitments towards AI infrastructure.

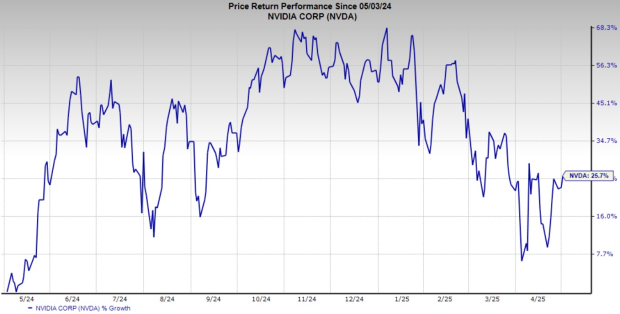

This surge in AI investment could signal a pivotal moment for NVIDIA’s stock, which has receded 27% from its 52-week high of $153.13 reached on January 7, 2025. With renewed enthusiasm in AI expenditure, potential investors may wonder: is it the right moment to buy more, or is holding the stock a wiser choice?

Image Source: Zacks Investment Research

Boost in AI Funding Could Increase Demand for NVIDIA Chips

Microsoft, a major cloud service provider and longstanding partner of NVIDIA, confirmed during its fiscal Q3 2025 earnings call that it will uphold its substantial $80 billion capital expenditure plan for AI data centers, with over half allocated to U.S. operations.

In parallel, Meta Platforms raised its 2025 capital spending forecast to between $64 billion and $72 billion, up from the previous estimate of $60 billion to $65 billion. This additional funding is mainly directed toward expanding data center capacity and AI infrastructure, which rely heavily on NVIDIA’s high-performance graphics processing units (GPUs).

Meta’s CFO, Susan Li, emphasized that the increase in capital expenditure is motivated by AI goals and infrastructure upgrades. Similarly, Microsoft CFO Amy Hood indicated that investments for fiscal 2026 will increase but at a slower rate, with a focus on short-term revenue gains, suggesting a ramp-up in AI workload deployments.

These commitments signal a strong demand for NVIDIA’s chips, especially the H100 and forthcoming B100 GPUs, as large tech providers scale their AI platforms.

AI Surge Fuels NVIDIA’s Financial Success

NVIDIA stands at the forefront of the ongoing AI revolution, attracting demand from hyperscalers, large enterprises, and innovative startups alike. The data center segment remains a significant growth driver for the company. In fiscal Q4 2025, revenues from this market soared 93% year-over-year to $35.58 billion, constituting 90.5% of total sales.

The rise of AI workloads, the expansion of cloud computing, and increased enterprise adoption of AI models have made NVIDIA’s advanced chips vital for businesses. With corporations investing heavily in AI infrastructure, NVIDIA is strategically positioned in this technological shift.

Financially, NVIDIA produced impressive results. In fiscal Q4 2025, revenues climbed 78% year-over-year, while non-GAAP EPS rose 71%. The company projects first-quarter fiscal 2026 revenues of $43 billion, a dramatic increase from $26.04 billion in the same quarter last year.

Analysts predict continued growth for NVIDIA, with expected revenue increases of 48% in fiscal 2026 and 24% in fiscal 2027. Expected earnings growth of 42% for fiscal 2026 and 27% for fiscal 2027 supports NVIDIA’s long-term investment case. The company has exceeded the Zacks Consensus Estimate for earnings in each of the past four quarters, averaging a surprise of 7.9%.

NVIDIA Corporation Stock Price, Consensus, and EPS Surprise

NVIDIA Corporation price-consensus-eps-surprise-chart | NVIDIA Corporation Quote

Caution Advised Due to Potential Overvaluation

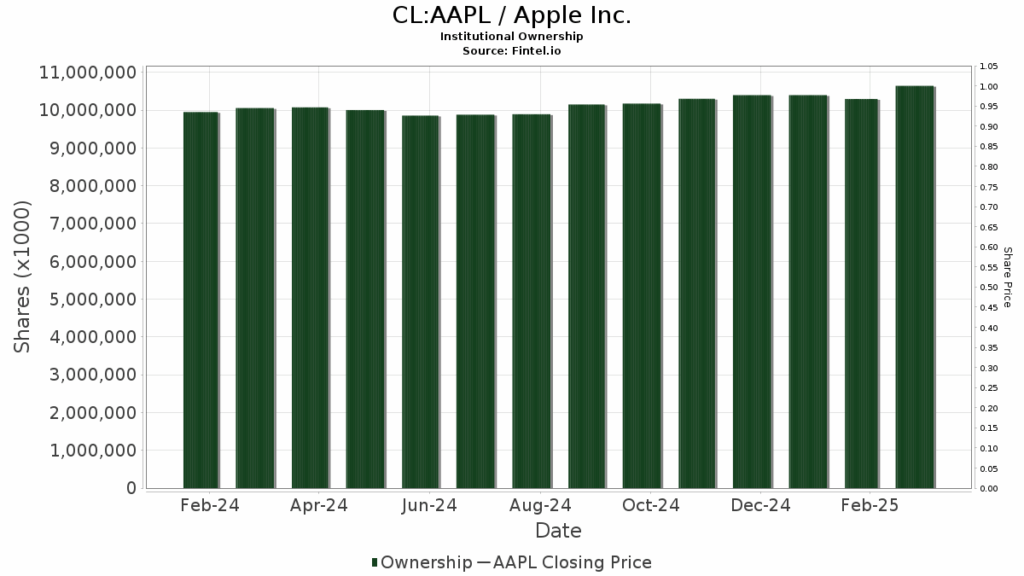

Despite its strong performance, NVIDIA’s valuation raises concerns. The stock holds a Zacks Value Score of D, indicating potential overvaluation.

In terms of forward 12-month Price/Sales, NVDA shares trade at 13.32X, which exceeds the Zacks Semiconductor – General industry average of 10.96X.

Image Source: Zacks Investment Research

Conclusion: Hold NVIDIA Stock for the Time Being

While NVIDIA’s stock is below its previous peaks, the AI megatrend remains vibrant, bolstered by significant investments from Meta Platforms and Microsoft. Their substantial commitments to AI infrastructure underscore NVIDIA’s critical role in the tech sector’s evolution. However, the company’s high valuation brings potential vulnerability to short-term market fluctuations. As a result, holding the stock appears to be a prudent strategy at this time.

Currently, NVIDIA holds a Zacks Rank #3 (Hold).