“`html

Quest Diagnostics Inc. (DGX) reported a market capitalization of $17.04 billion and aims to sustain growth despite rising debt levels of $5.65 billion as of Q3 2024. The company’s earnings have surpassed estimates for four consecutive quarters, with an average surprise of 3.41%.

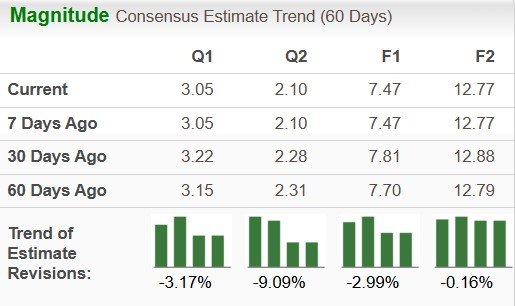

In Q3 2024, Quest Diagnostics experienced robust volume growth in its core business, excluding COVID-19 testing, attributed to new physician and hospital customers, leading to increased demand for advanced diagnostics. The Zacks Consensus Estimate for the company’s 2024 earnings per share (EPS) stands at $8.90, while estimated revenue is $9.82 billion, signifying a 6.2% increase from the previous year.

The company’s automated testing initiatives are aimed at enhancing productivity and addressing inflationary pressures, with notable projects underway in its Lenexa, KS, laboratory. However, increasing debt and industry risks such as fluctuations in healthcare utilization and reimbursement challenges may adversely affect its stock performance.

“`