Yelp Faces Challenges Amidst Stiff Competition and Market Pressure

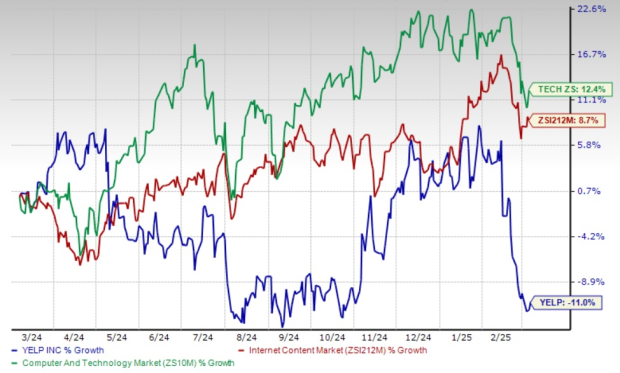

Yelp YELP, a platform dedicated to connecting users with local businesses, has seen its shares drop 11% over the past year. This decline stands in stark contrast to the Zacks Computer and Technology sector’s 12.4% gain, and the Zacks Internet – Content industry’s 8.7% rise. These figures underscore the difficulties Yelp is encountering due to weaknesses in its restaurant and retail business segments as well as increasing competition.

Declining Revenue in Key Segments

Yelp’s Restaurant, Retail and Other (RR&O) segment has recorded decreasing revenues for five consecutive quarters. The ongoing macroeconomic challenges impacting consumer spending have created hurdles for restaurant and retail businesses that predominantly use Yelp’s services in the RR&O category. In the fourth quarter of 2024, sales in this division fell by 3% year over year, totaling $470 million.

Advertising Revenue Dependency

Advertising revenues constitute over 95% of Yelp’s total income. Ironically, its largest revenue source relies heavily on its competitor, Google, a subsidiary of Alphabet GOOGL, which directs traffic to Yelp’s site. Additionally, significant competition arises from other advertising platforms held by giants like Microsoft MSFT and Meta META.

The influence of Google’s AI, Google Maps, Google My Business, and search ads complicates Yelp’s advertising operations. Similarly, Microsoft’s search engine, Bing, provides local search results akin to those of Yelp. Social media giants Meta, with their Facebook and Instagram platforms, further intensify competition, offering business pages, targeted advertisements, and user-generated reviews. Despite these challenges, Yelp’s expanding expertise in its advertising offerings is contributing to its growth potential.

1-Year Price Return Performance

Image Source: Zacks Investment Research

Growth in Advertising Services

Despite its heavy reliance on advertising revenues, Yelp’s advertising services division has shown consistent growth. In 2024, advertising revenues in this segment rose by 10.8% year over year, reaching $879 million. This increase is attributed to strong advertiser demand and a rise in the number of paying advertising locations.

The company is also transitioning to offer advertising plans without a fixed duration, which is bolstering the growth of paying advertiser accounts. Furthermore, Yelp is experiencing solid retention rates among cost-per-click (CPC) advertisers. By providing a diverse range of pricing options, Yelp is enhancing user engagement.

Investments in Technology Yield Results

Yelp’s ongoing investment in artificial intelligence and machine learning has improved ad clicks while lowering average CPC. The company has also executed several user experience enhancements, including accessibility features. These initiatives reflect Yelp’s broader commitment to enriching user experiences, likely leading to increased engagement and customer loyalty, which in turn supports ongoing revenue growth.

For 2025, Yelp anticipates revenues between $1.47 billion and $1.485 billion. The Zacks Consensus Estimate for revenues stands at $1.48 billion, reflecting a 5% year-over-year growth expectation. Additionally, the consensus earnings estimate is $2.15 per share, suggesting a 14.4% increase from the previous year.

Investor Recommendations

While Yelp navigates substantial headwinds due to economic and competitive factors, it has managed to achieve revenue growth primarily through its strength in advertising services. Given the current situation, it is advisable for investors to maintain the Zacks Rank #3 (Hold) for this stock. For those interested in broader opportunities, a complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

Just Released: Zacks Top 10 Stocks for 2025

Act quickly—you can still secure positions in our top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this selection has shown remarkable and consistent success. Since its inception in 2012 up until November 2024, the Zacks Top 10 Stocks portfolio has gained over 2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has analyzed 4,400 companies covered under the Zacks Rank, selecting the best 10 to accumulate and hold for 2025. You still have a chance to be among the first to view these newly released stocks with significant potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to access this free report.

Microsoft Corporation (MSFT) : Free Stock Analysis report

Yelp Inc. (YELP) : Free Stock Analysis report

Alphabet Inc. (GOOGL) : Free Stock Analysis report

Meta Platforms, Inc. (META) : Free Stock Analysis report

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.