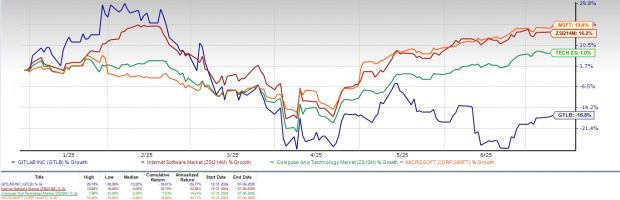

GitLab (GTLB) has seen its shares decline 16.8% year-to-date, significantly underperforming the Zacks Computer & Technology sector’s 7% gain and the Internet – Software industry’s 16.2% rise. Contributing factors include macroeconomic uncertainties and intensified competition in AI-enabled DevSecOps, especially from Microsoft (MSFT), which has gained 19.4% during the same period. Despite this, GitLab reports strong demand for its solutions, including GitLab Ultimate and GitLab Duo, with customers yielding over $5K in Annual Recurring Revenue (ARR) increasing by 13% year-over-year.

For Q2 FY2026, GitLab expects revenues between $226 million and $227 million, a growth of approximately 24% year-over-year, with non-GAAP earnings projected between 16 and 17 cents per share. For the full fiscal year, revenues are anticipated to be between $936 million and $942 million, also indicating a growth of around 24%.

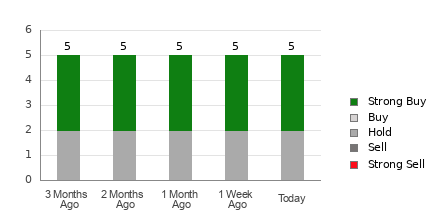

The Zacks Consensus Estimate for Q2 earnings stands at 16 cents per share, and revenue estimates are reported at $226.55 million, reflecting a 24.08% year-over-year increase. GitLab currently holds a Zacks Rank of #3 (Hold), suggesting potential investors may want to wait for a more favorable entry point.