“`html

Vertiv’s Stock Struggles Amid Market Challenges

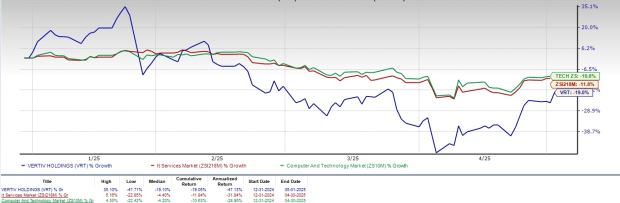

Vertiv (VRT) shares have dropped 19% year to date, trailing behind the overall decline of 10.6% in the Zacks Computer and Technology sector and an 11.8% fall in the Zacks Computers – IT Services industry.

The decline in Vertiv’s stock price stems from rising macroeconomic pressures and U.S. President Donald Trump’s tariffs on major trading partners like China, Mexico, and Canada. These developments have heightened concerns over a potential trade war.

Compared to its closest competitor, Eaton (ETN), which is actively expanding its sustainable energy solutions and market presence, Vertiv has struggled. Eaton has committed over $8 billion to transformative portfolio management but has also seen its shares decline by 11.3% this year.

VRT Stock Price Performance

Image Source: Zacks Investment Research

Despite the stock’s underperformance, Vertiv boasts a robust product portfolio encompassing thermal systems, liquid cooling, uninterruptible power supplies, switchgear, busbars, and modular solutions. Over the past 12 months, the company has experienced approximately 20% growth in organic orders, along with a book-to-bill ratio of 1.4 for Q1 2025. This bodes well for future prospects, evidenced by a backlog growth of 10% sequentially and 25% year over year, totaling $7.9 billion.

The pressing question remains: Can Vertiv navigate these macroeconomic hurdles, leverage its strong product lines, and recover from its recent stock decline?

Vertiv’s Expanding Portfolio Aids Prospect

Vertiv is actively enhancing its portfolio. In March, it introduced four systems aimed at fulfilling the increasing demands of AI applications. These systems include Vertiv Unify for infrastructure management, SmartRun modular prefabricated solutions, CoolLoop RDHx high-density heat exchangers, and PowerDirect Rack high-density DC power shelves, all focused on improving thermal management and power efficiency for AI-driven data centers.

Additionally, the company launched the Vertiv CoolLoop Trim Cooler, designed to optimize air and liquid cooling solutions for AI and High-Performance Computing applications. This system promises up to 70% energy savings and a 40% reduction in space usage.

Vertiv Benefits From Rich Partner Base

A key asset for Vertiv is its diverse partner network, which includes notable companies such as Ballard Power Systems, Compass Datacenters, NVIDIA (NVDA), Intel, ZincFive, and Tecogen (TGEN).

To enhance its offerings, Vertiv collaborated with Tecogen in March 2025 to deploy advanced natural gas-powered chiller technologies to global data centers, aiding in power constraints and supporting AI scalable implementations. Tecogen’s 40 years of experience in clean energy solutions adds significant value to Vertiv’s cooling product line.

In April 2025, Vertiv announced a partnership with NVIDIA and iGenius to develop Colosseum, a modular, energy-efficient AI supercomputer in Italy, aiming for launch during 2025. This initiative will cater to regulated industries using NVIDIA DGX systems and Omniverse-powered digital twin technology.

VRT Raises Guidance

For 2025, Vertiv has adjusted its revenue guidance to a range of $9.325 billion to $9.575 billion. Organic net sales growth is anticipated between 16.5% and 19.5%.

The company now expects 2025 non-GAAP earnings per share of $3.45 to $3.65. Earlier projections suggested revenues between $9.125 billion to $9.275 billion, with an anticipated organic net sales growth of 15% to 17%. Non-GAAP earnings per share were initially expected to range from $3.50 to $3.60.

For the second quarter of 2025, Vertiv forecasts revenues between $2.325 billion and $2.375 billion, with anticipated organic net sales growth of 19% to 23%. Non-GAAP earnings per share for this period are expected between 77 cents and 85 cents.

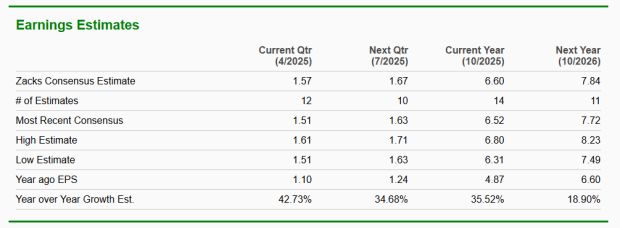

VRT’s Earnings Estimates Remain Consistent

The Zacks Consensus Estimate for Vertiv’s second-quarter 2025 revenues stands at $2.27 billion, indicating a year-over-year growth of 16.48%.

For second-quarter 2025 earnings, the estimate is currently 82 cents per share, a 9.8% decrease over the past 30 days but still projecting a 22.39% year-over-year increase.

For 2025, the revenue estimate is pegged at $9.51 billion, suggesting an 18.71% increase from the previous year. The earnings estimate for the same period stands at $3.55 per share, a slight decline of 1.11% in the last month, projecting a 24.56% increase compared to the figure reported in 2024.

Vertiv Holdings Co. Price and Consensus

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Vertiv’s earnings have consistently outperformed the Zacks Consensus Estimate over the past four quarters, with an average surprise of 10.42%.

Vertiv Stock is Trading at a Premium

Despite its strengths, Vertiv currently appears overvalued, reflected by a Value Score of C.

For the last 12 months, Vertiv has a Price/Book ratio of 12.19X, compared to the average of 8.90X for the broader Computer and Technology sector.

Price/Book Ratio

Image Source: Zacks Investment Research

Conclusion: Hold Vertiv Stock for Now

Although Vertiv is leveraging its strong portfolio and extensive partner relationships to drive growth, it faces significant challenges from macroeconomic factors, competition, and valuation concerns. Currently, VRT has a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more favorable entry point before acquiring shares.

“`# Analysts Highlight Top Stocks Expected to Surge in Value

Zacks Reveals Its Top Stock with the Greatest Potential to Double

A recent update from Zacks Investment Research announced a selection of five stocks poised for substantial growth, each expected to gain 100% or more in the upcoming months. Among these, Sheraz Mian, the Director of Research at Zacks, has pinpointed one stock as particularly promising.

This standout company ranks as one of the most innovative financial firms. With a rapidly growing customer base exceeding 50 million, it offers a range of cutting-edge solutions, positioning itself for significant upward movement. While not every selection from Zacks achieves similar success, this particular stock aims to surpass previous high performers, including Nano-X Imaging, which surged by 129.6% in just over nine months.

In addition to the highlighted stock, Zacks also recommends several other compelling picks. Interested investors can examine these choices further.

To access Zacks’ latest recommendations and a comprehensive analysis of the top seven stocks for the next 30 days, available resources include:

- Eaton Corporation, PLC (ETN): Free stock analysis report

- NVIDIA Corporation (NVDA): Free stock analysis report

- Tecogen Inc. (TGEN): Free stock analysis report

- Vertiv Holdings Co. (VRT): Free stock analysis report

This information is based on insights provided by Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.