Intel Faces Challenges as Stock Prices Plummet in 2024

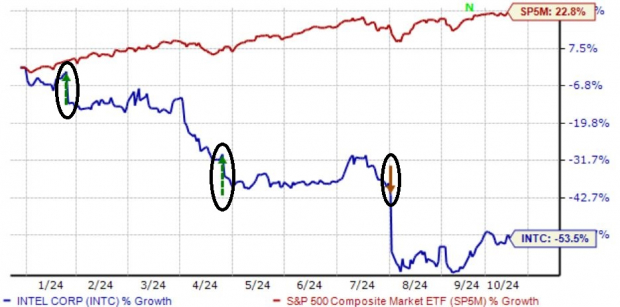

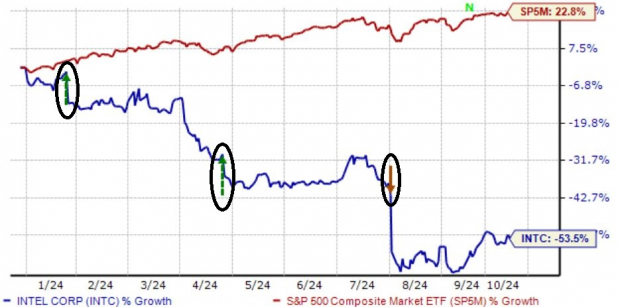

Intel INTC shares have been underperforming in 2024, struggling to gain traction in the semiconductor market and down more than 50%. Recent quarterly results have only worsened investor sentiment, leaving the stock with little momentum post-earnings.

Below is a chart illustrating the year-to-date performance of Intel shares compared to the S&P 500, highlighting its quarterly results marked by circled arrows.

Image Source: Zacks Investment Research

Given the sharp decline from its previous highs, is it time to consider purchasing Intel shares? Let’s examine the situation further.

Intel’s Grim Forecast

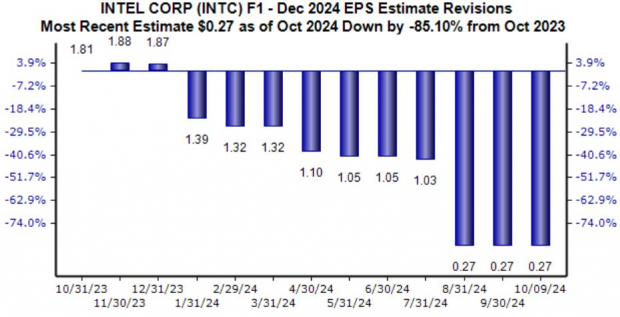

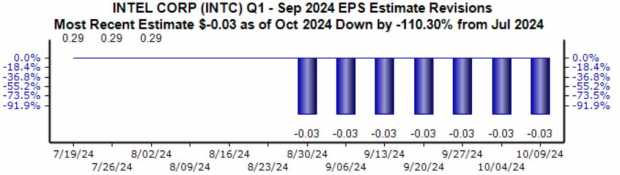

Currently, Intel holds a Zacks Rank #4 (Sell), indicating negative earnings estimate revisions from analysts. The projection for its current fiscal year is particularly poor, with the $0.27 Zacks Consensus EPS estimate plunging 85% over the past year.

These downward revisions, resulting from disappointing quarterly results, suggest challenging near-term prospects for the stock.

Image Source: Zacks Investment Research

Despite these challenges, CEO Pat Gelsinger has shown confidence by purchasing 12.5k shares, totaling around $250k in early August, following the recent earnings report. He acknowledged the difficulties expected in the second half but emphasized the company’s intent to regain its market standing.

Furthermore, Intel is implementing cost-cutting strategies in response to ongoing margin pressures, targeting $10 billion in savings as announced earlier in August.

Please note, the chart below reflects a trailing twelve-month period.

Image Source: Zacks Investment Research

Should Investors Consider Buying Intel Shares?

For now, investors may want to stay cautious and wait for positive earnings estimate revisions. Such updates would suggest a change in market sentiment. Earnings expectations have already been revised downward for the upcoming release set for October 24th, with a loss anticipated at -$0.03 per share.

Image Source: Zacks Investment Research

Stay informed about all quarterly announcements: Check the Zacks Earnings Calendar.

Interestingly, INTC shares recently experienced a rally, gaining nearly 20% in the last month. While this surge might seem promising, it is largely attributed to a short squeeze driven by buyout rumors.

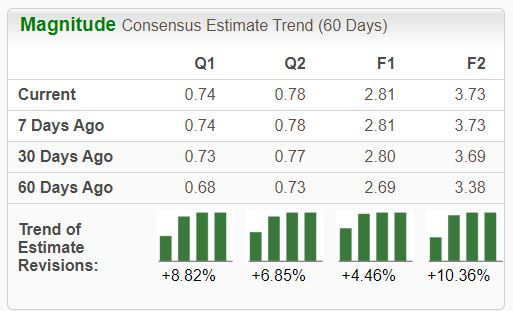

For those looking to invest in the semiconductor sector, several companies are showing more favorable trends. Nvidia NVDA, for example, has a Zacks Rank #2 (Buy), and its earnings outlook has improved following exceptional quarterly results.

Nvidia’s revenue is projected to double in the current fiscal year, highlighting its robust market position.

Image Source: Zacks Investment Research

Only $1 to Access All Zacks’ Recommendations

No, this is not a promotion.

A few years back, Zacks surprised members with a special offer: 30-day access to all picks for just $1. There was no obligation to continue, yet many chose not to participate, thinking there must be a catch. The real reason was simple: we wanted to familiarize you with services like Surprise Trader, Stocks Under $10, Technology Innovators, and many others, which collectively gained double- and triple-digit profits in 2023 alone.

Want the most recent recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double for free. Click to obtain this report.

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.