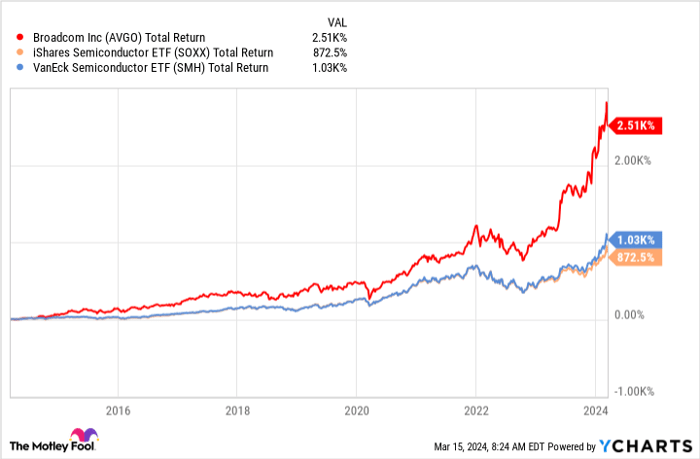

Broadcom (NASDAQ: AVGO), a stalwart in the turbulent seas of the semiconductor industry, has been nothing short of awe-inspiring. Over the past decade, the company’s stock prices have surged by over 2,500%, leaving average returns in the semiconductor sector in the dust. As a shareholder basking in the glow of this success story, I stand witness to Broadcom’s remarkable journey.

Data by YCharts.

Under the astute leadership of CEO Hock Tan, Broadcom has masterfully navigated the choppy waters of the industry by acquiring strategic tech assets catering to the burgeoning markets of semiconductors and software. Despite a meteoric rise in recent years, the question looms – is it time to offload some Broadcom stock?

Broadcom’s Resilience Amidst Industry Turbulence

While much of the semiconductor sector has been weathering a severe downturn, Broadcom has stood tall, resilient against the storm. From the decline in smartphone and PC chips in late 2022 to the recent hit on the automotive and industrial automation markets, the industry has been rocked. However, Broadcom’s diversified approach, encompassing both semiconductor design and enterprise software, has kept it on a growth trajectory.

Data by YCharts.

Q1 of fiscal 2024 exhibited a strong start with a 4% year-over-year increase in semiconductor segment sales. Even without factoring in the VMware acquisition from late 2023, Broadcom’s software segment is gaining momentum, driven by customer upsells leveraging VMware assets. Evidently, the path ahead seems paved with continued financial prosperity.

|

Broadcom Sales by Segment |

Q1 Fiscal 2024 |

Change (YOY) |

Fiscal 2024 Guidance |

|---|---|---|---|

|

Networking (including AI and computing offload) |

$3.3 billion |

46% |

35% |

|

Wireless (mostly Apple) |

$2 billion |

(4%) |

Flat |

|

Storage connectivity |

$887 million |

(29%) |

Down mid-20% range |

|

Broadband |

$940 million |

(23%) |

Down 30% |

|

Industrial |

$215 million |

(6%) |

Down high-single-digit % |

|

Total semiconductor sales |

$7.4 billion |

4% |

Up mid- to high-single-digit % |

|

Infrastructure software |

$4.6 billion ($2.1 billion from VMware) |

156% (39% when excluding VMware) |

$20 billion |

|

Total Broadcom revenue |

$12 billion |

34% (11% when excluding VMware) |

$50 billion (including VMware) |

Data source: Broadcom. YOY = year over year.

Noteworthy are the AI chip sales propelling the “networking” segment towards remarkable growth, with a significant contribution from TSMC. Despite headwinds, Broadcom continues its upward journey, relentless in its pursuit.

The Magic of Free Cash Flow

Throughout the years, shareholders have reveled in Broadcom’s bountiful free cash flow (FCF), boasting profit margins nearing or surpassing an impressive 50%. Post the VMware acquisition, the recent dip to a still commendable 39% FCF margin reflects the ongoing integration process.

Anticipate a gradual uptick in this metric in the foreseeable future, driven by Tan and his team harnessing growth synergies with VMware and extracting higher profits from the cloud software giant. The enhanced FCF will play a crucial role in offsetting the debt incurred from the acquisition. With $11.9 billion in cash and short-term investments juxtaposed with $73.5 billion in debt, Broadcom is diligently streamlining its financial stance.

Trading at 30 times trailing-12-month free cash flow, Broadcom’s valuation reflects its substantial debt obligations. However, sustained revenue growth and expanding profit margins signal a promising future. While not the most opportune semiconductor stock to buy presently, selling seems premature. Broadcom continues to shine as a perennial favorite among long-term investors.

Considering an investment of $1,000 in Broadcom?

Prior to diving into Broadcom shares, ponder this:

The Motley Fool Stock Advisor analyst team recently pinpointed their top 10 stock picks for investors to seize, each harboring potential for formidable returns. Notably absent from this elite group was Broadcom. The chosen 10 equities hold the promise of substantial growth in the ensuing years.

Stock Advisor furnishes a roadmap to prosperity, guiding investors through portfolio construction, analyst insights, and bi-monthly stock selections. Since 2002, this service has outstripped the S&P 500 return by a significant margin*.

Explore the 10 stocks

*Stock Advisor returns as of March 11, 2024

Nicholas Rossolillo holds positions in Apple, Broadcom, and Nvidia. The Motley Fool maintains positions in and endorses Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool advocates for Broadcom. The Motley Fool abides by a disclosure policy.

The perspectives articulated in this content are those of the author and may not reflect the viewpoints of Nasdaq, Inc.