NVIDIA Corporation (NVDA) is set to release its fiscal Q2 2026 earnings soon, amid heightened market interest due to optimism surrounding artificial intelligence (AI) and the demand for graphics processing units (GPUs). The company anticipates revenues of $45 billion for the quarter, an approximate 50% year-over-year increase, following a revenue of $44.1 billion in Q1, which reflected a 69% year-over-year growth.

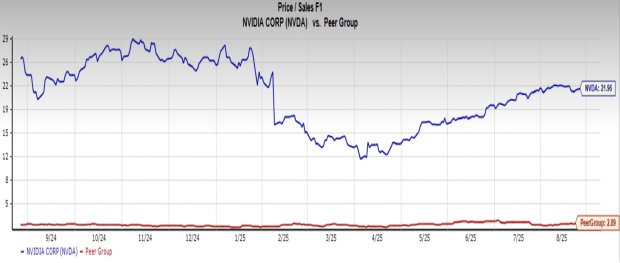

Despite the strong demand, concerns have been raised regarding NVIDIA’s high valuation, with a forward price-to-sales (P/S) ratio of 21.96 compared to the industry average of 2.09. A potential earnings shortfall could lead to a significant decline in share price. Moreover, ongoing regulatory challenges in China and increasing competition from companies like Advanced Micro Devices, Inc. (AMD) could further impact NVIDIA’s market position.

Conversely, NVIDIA is expected to benefit from a recovery in chip sales to China, projected at $8 billion, and from increased capital expenditure on data centers by major companies such as Alphabet, Meta, Amazon, and Microsoft. Analysts suggest retaining NVIDIA shares for long-term growth, given the company’s strong past earnings surprises averaging 3.9%.