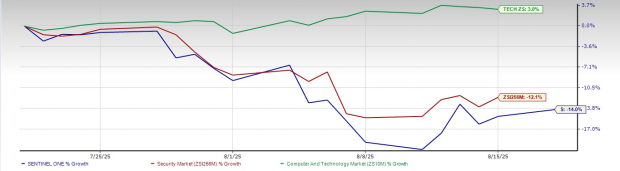

SentinelOne (ticker: S) shares dropped 14% in the past month, significantly underperforming the Zacks Computer & Technology sector’s 3% return and the Zacks Security industry’s 12.1% decline. This setback is mainly due to challenging macroeconomic conditions leading to prolonged sales cycles and customer spending pauses, impacting net new annual recurring revenue (ARR) growth.

Growth and Financial Metrics

Despite recent struggles, SentinelOne’s long-term growth strategy is supported by its innovative Singularity platform. In the first quarter of fiscal 2026, ARR increased 24% year-over-year to $948.1 million, with over 1,400 customers generating ARR exceeding $100K. The company anticipates second-quarter revenues around $242 million, reflecting a 21.7% year-over-year growth, with earnings expectations at 3 cents per share, a 200% increase compared to the previous year.

Market Position and Challenges

While SentinelOne has a robust portfolio and expanding partnerships with companies like Amazon and CyberArk, it faces stiff competition from established players such as CrowdStrike and Microsoft. The company currently holds a Zacks Rank #4 (Sell), indicating potential risks for investors amid ongoing macroeconomic challenges and uncertainty surrounding federal budget allocations.