Oracle’s Security Breaches and Financial Struggles Worry Investors

Oracle (ORCL) is grappling with significant security issues that threaten its standing in the market and investor trust. Following two confirmed security breaches in one month, doubts about the company’s ability to safeguard sensitive client information are growing, particularly alongside its disappointing financial results.

Security Breaches Elicit Concern

Recent reports reveal that Oracle informed clients about a second cybersecurity breach where hackers compromised client login credentials. This incident is currently under investigation by the FBI and cybersecurity firm CrowdStrike. Notably, this breach is reported to be distinct from another attack disclosed to healthcare customers in March.

Initially, Oracle refuted claims of a successful breach of its cloud storage. However, the company later confirmed to clients that an attacker had accessed what it referred to as a legacy environment. To minimize the situation’s gravity, Oracle asserted that the affected system had seen no use in eight years, implying limited risk from the compromised credentials.

Contradicting this statement, a source familiar with the situation disclosed that the stolen data included credentials potentially active as recent as 2024. Trustwave Holdings, a cybersecurity research firm, corroborated the legitimacy of the data being sold online, identifying it as a trove that could facilitate phishing and account takeover attacks.

Healthcare Data at Risk from Previous Breach

This most recent breach follows another incident where hackers infiltrated Oracle’s servers and extracted patient data, likely in an attempt to extort U.S. medical providers. Following the breach, Oracle informed users of its patient records management software that after January 22, hackers had copied patient data to an external location.

This situation is intensified by Oracle’s significant $28 billion acquisition of Cerner Corp. in 2022, which bolstered its role in the electronic health record market. This acquisition included a $16 billion contract with the U.S. Department of Veterans Affairs, an organization facing scrutiny due to previous outages.

Financial Results Fall Short of Expectations

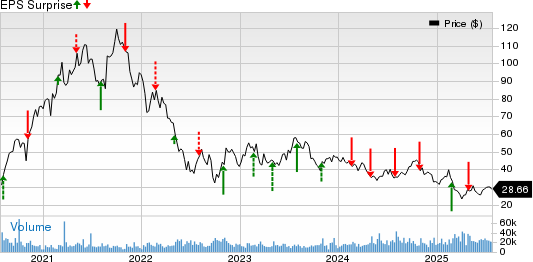

Aside from security threats, Oracle’s financial performance further complicates the outlook for its investors. The company’s third-quarter fiscal 2025 results fell short of analysts’ expectations in both earnings and revenue metrics. Oracle reported non-GAAP earnings of $1.47 per share, missing estimates by 0.68%, while revenue of $14.13 billion underperformed projections by 1.59%.

In the fiscal third quarter alone, ORCL’s capital expenditures surged to $5.9 billion, nearly matching its operating cash flow for that period. Management forecasts that capital expenditures will hit approximately $16 billion for fiscal 2025, more than double the previous year’s levels. This aggressive investment strategy is straining the company’s free cash flow, which has plummeted by 53% over the past 12 months.

The consensus estimate for fiscal 2025 earnings stands at $6.04 per share, reflecting a 2.9% decline over the past month.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

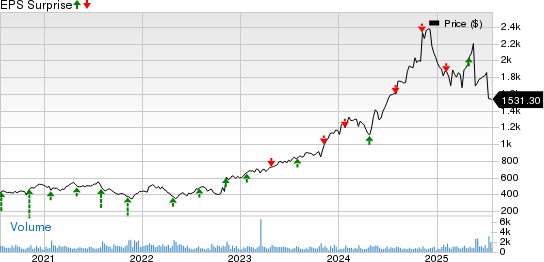

Currently, Oracle trades at an EV/EBITDA multiple of 16.76, which is significantly higher than the Zacks Computer-Software industry average of 14.76x. This elevated valuation implies investors expect remarkable growth—growth that Oracle is increasingly failing to achieve with a modest year-over-year revenue increase of only 6% (or 8% in constant currency).

ORCL’s EV/EBITDA Ratio Shows High Valuation

Image Source: Zacks Investment Research

Supply Chain Issues Hinder Cloud Services Growth

In its recent earnings call, Oracle admitted that delays in component availability have restricted its cloud capacity expansion. This limitation is concerning for a company that aims to be a key provider of infrastructure for AI workloads. Competitors like Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) are swiftly enhancing their infrastructure to meet burgeoning AI demands, leaving Oracle at a potential competitive disadvantage that could erode its market share.

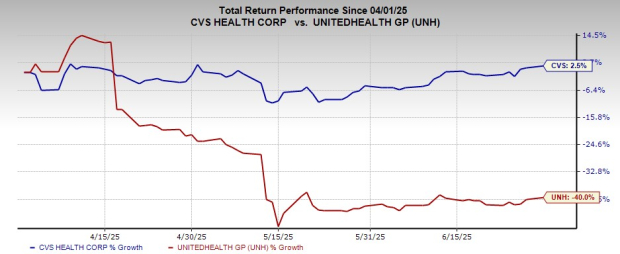

Performance on Wall Street also presents a more complicated narrative. ORCL has decreased by 25.3% year-to-date, underperforming both the broader Zacks Computer & Technology sector and the S&P 500, which have declined by 22.4% and 15.6% respectively. Stocks from Alphabet, Microsoft, and Amazon have similarly lagged behind but showed less steep declines of 23.6%, 15.9%, and 22.2%, respectively, over the past year.

Year-to-Date ORCL Stock Price Performance

Image Source: Zacks Investment Research

Investment Outlook: Consider Selling ORCL Stock

The combination of critical security breaches, disappointing earnings, limited capacity growth, and declining free cash flow paints a troubling picture for Oracle investors. Despite the company’s assertions about substantial AI-related contracts, actual revenue growth remains tepid, casting doubts on Oracle’s competitive future in the rapidly evolving cloud infrastructure sector.

In light of these ongoing challenges, Oracle’s Zacks Rank of #4 (Sell) is aptly supported. The notable year-to-date slump of 25.3% could suggest a prudent moment for investors to reassess their stakes. Given the company’s inability to demonstrate significant growth despite heavy capital investments and the damaging impact of multiple security incidents on customer confidence, the fundamental groundwork for ORCL stock has weakened considerably.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Potentially Double

Each of these stocks was selected by a Zacks expert as the #1 pick expected to gain 100% or more in 2024. While not all recommendations will be successful, previous selections have recorded impressive returns of +143.0%, +175.9%, and +498.3%.

Unlocking Hidden Potential: Stocks Flying Under Wall Street’s Radar

Some lesser-known stocks are making impressive gains, with one company achieving an astonishing growth of +673.0%. These stocks have largely evaded the attention of Wall Street analysts, presenting a prime opportunity to investors looking for strong entry points.

Explore These 5 Potential Home Runs Today >>

Additionally, if you’re seeking fresh insights, download Zacks Investment Research’s latest recommendations. You can access their analysis of the 7 Best Stocks for the upcoming 30 days free of charge.

If you’re interested in specific company analyses, we have reports available for:

- Amazon.com, Inc. (AMZN)

- Microsoft Corporation (MSFT)

- Oracle Corporation (ORCL)

- Alphabet Inc. (GOOGL)

This insightful article was initially published on Zacks Investment Research.

For further financial analysis, you can visit Zacks Investment Research.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.