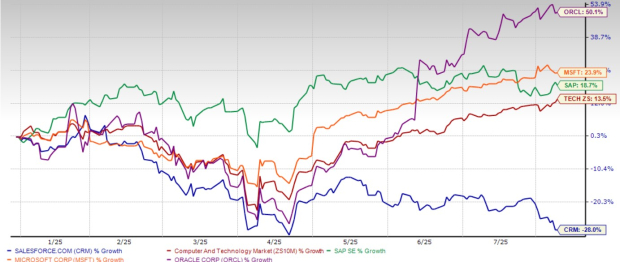

Salesforce, Inc. (CRM) has seen its stock decline 28% in 2025, significantly underperforming the broader Zacks Computer and Technology sector, which fell 13.5%. In contrast, key competitors including SAP SE (SAP), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL) reported year-to-date increases of 18.7%, 23.9%, and 50.1%, respectively.

The company’s first-quarter fiscal 2026 revenue grew only 7.7% year-over-year, with non-GAAP earnings per share (EPS) increasing by 5.7%. Analysts predict mid-to-high single-digit growth rates for the next two fiscal years. Salesforce’s EPS is projected to witness a compound annual growth rate (CAGR) of just 12.9% over the next five years, down from 27.8% in the previous five years.

Despite its discounted valuation—with a forward price-to-earnings (P/E) ratio of 20.08 compared to the sector average of 28.15—investors are wary of potential value traps given ongoing challenges in sales growth.