Celsius Holdings (NASDAQ: CELH) has set Wall Street ablaze, blazing a trail as one of the most scorching stocks over the last half-decade. With its growth engine revving at full throttle, Celsius has expanded its reach from a regional favorite to a national sensation, propelling the company into overdrive. As investors navigate the turbulent waters of the stock market, the question remains – is it too late to hop on the Celsius bandwagon and ride the wave of potential prosperity?

Image source: Getty Images.

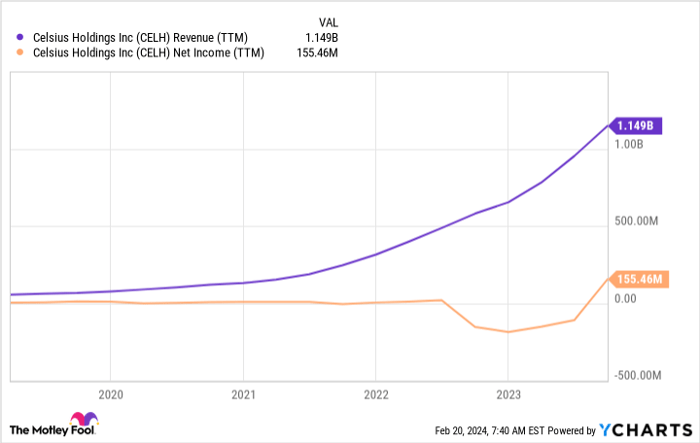

Unstoppable Growth Trajectory

Like a speeding bullet, Celsius has been on a relentless growth spree, fueled by its sought-after product and a game-changing distribution pact inked with industry titan, PepsiCo (NASDAQ: PEP) in 2022. The strategic move, which coincided with the cessation of distribution agreements with former partners, has ignited a spark in the company’s financials with a trajectory that outshines the competition. Although not devoid of risks, Celsius Holdings continues to steer profitability along the upward trajectory of growth.

CELH Revenue (TTM) data by YCharts

By harnessing Pepsi’s distribution prowess, Celsius has rapidly penetrated the North American market, where a staggering 96% of its revenue hails from the last quarter. However, the potential for international expansion remains largely untapped, presenting a golden opportunity for exponential growth. The asset-light model of Celsius, intertwined with a robust supply chain orchestrated by copackers and Pepsi, has paved the way for profitable expansion without the burden of heavy infrastructure investments. This nimble approach positions Celsius as a design and branding powerhouse in the beverage industry.

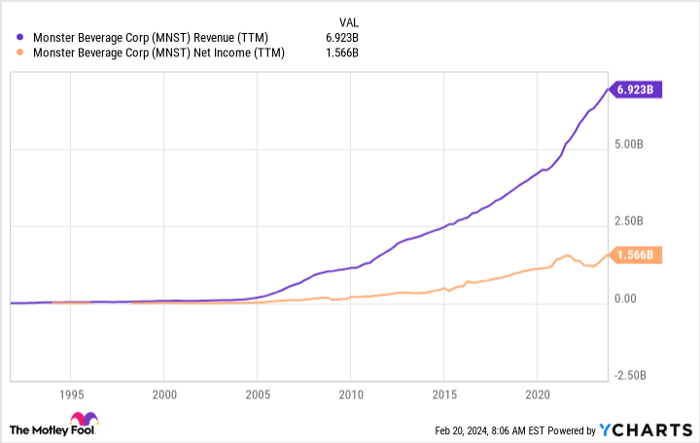

Riding the Wave of Success: Lessons from Energy Drink Titans

The scorching growth and lofty valuation of Celsius may raise eyebrows, trading at 66 times upcoming year analyst estimates while analysts foresee a staggering 66% revenue surge in the next biennium. Nevertheless, history serves as a guiding light, with Monster Beverage (NASDAQ: MNST) exhibiting a similar growth trajectory and valuation profile, outpacing the market with robust revenue growth year after year.

MNST Revenue (TTM) data by YCharts

Celsius’ expansive target market, coupled with its mass appeal and refined branding, sets it apart from its competitors, potentially positioning it for a more substantial market share than Monster. The allure of Celsius’ product, nestled between traditional soda and premium waters, has resonated with consumers, paving the path for substantial market share gains.

Celsius: A Flame in the Retail Fires

Frequently categorized as an energy drink, Celsius transcends mere categorization, offering a versatile product that caters to a diverse consumer base. Positioned as a healthier alternative to traditional sodas, Celsius boasts low calories, essential vitamins, and an array of tantalizing flavors, bridging the gap between water and sugary beverages. With a growing presence in prominent retailers, eateries, and coffee shops, Celsius emerges not as a niche offering but as a mainstream product catering to evolving consumer preferences.

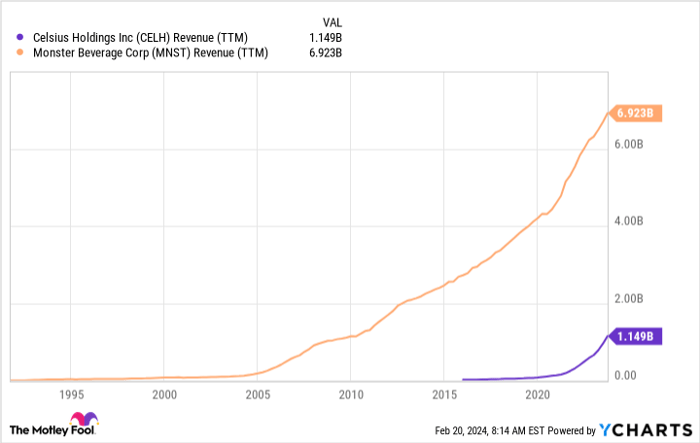

The immense potential of Celsius remains a puzzle yet to be fully unraveled. As the company fortifies its shelf space and embarks on international forays, 2024 poses as a pivotal milestone in its growth trajectory. With a potential to surpass the market giants, Celsius’ six-fold revenue growth could dwarf expectations, presenting a compelling case for prospective investors.

CELH Revenue (TTM) data by YCharts

Riding the Wave of Success: Lessons from Energy Drink Titans

Fear not the tide of opportunity sweeping Celsius Holdings, for operational vitality acts as a key propellant for consumer-centric brands. As Celsius continues its nationwide expansion, a growing legion of consumers embrace its offerings, heralding a phase of rapid adoption and integration into their daily consumption habits.

The growth trajectory set in motion harbors the promise of a decade-long ascendancy as Celsius intensifies its retail footprint and ventures into uncharted global markets. A prospect of Celsius eclipsing Monster in scale could fundamentally transform its $14.9 billion market capitalization into a bargain purchase for savvy investors today.

As we closely monitor growth rates in the ensuing years, Celsius stands as a beacon of promise for long-term investors, poised to reign victorious on the stock market battleground.

Should you invest $1,000 in Celsius right now?

Before delving into Celsius stock, ponder this:

The Motley Fool Stock Advisor analysts have pinpointed the 10 best stocks primed for massive growth potential. While Celsius may not feature in this elite cadre, these distinguished stocks hold the promise of substantial returns in the foreseeable future.

The Stock Advisor confers a roadmap to investment success, offering expert advice on portfolio construction, frequent analyst updates, and a bountiful selection of stock picks. Since 2002, the Stock Advisor service has tripled the returns of the S&P 500 index*, embodying a hallmark of guidance and acumen in the investment universe.

Explore the 10 stocks

*Stock Advisor returns as of February 20, 2024

Travis Hoium holds positions in Celsius. The Motley Fool has positions in and endorses Celsius and Monster Beverage. The Motley Fool adheres to a disclosure policy.

The perspectives and views articulated herein are those of the author’s alone and do not necessarily mirror the stance of Nasdaq, Inc.