For investors contemplating a foray into the energy sector, Chevron (NYSE: CVX) emerges as a compelling choice. However, the ultimate decider of the company’s financial fate and stock performance lies in the unpredictable realms of oil and natural gas pricing. This inherent volatility in the energy market necessitates a prudent approach for prospective investors eyeing Chevron’s stock. Yet, Chevron presents a mixed bag of favorable attributes vis-a-vis its industry peers, making it a stock to watch closely. Let’s delve into the details that may influence your investment decision.

The Temptation of Chevron’s Yield

In a hypothetical face-off between two behemoths in the energy landscape, Chevron and fellow American giant ExxonMobil (NYSE: XOM) would undoubtedly snag the spotlight. Both players boast integrated operations, U.S. headquarters, and a steadfast focus on traditional fossil fuels (unlike their European counterparts embracing clean energy endeavors).

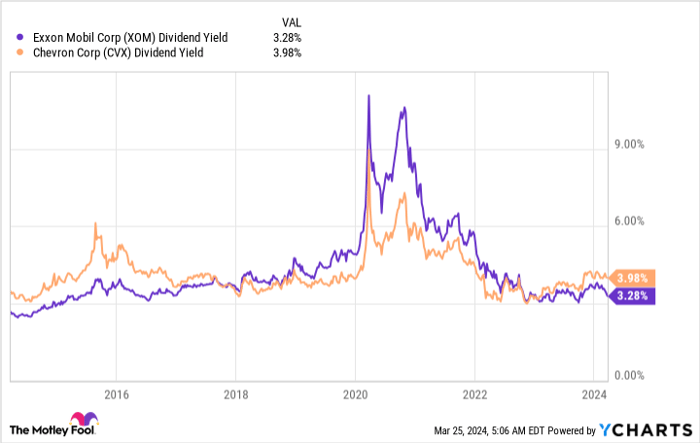

Comparing these titans yields an interesting insight: Chevron’s dividend yield stands at a tantalizing 4.2%, overshadowing Exxon’s more modest 3.3%. This divergence holds significance, especially in a percentage-driven valuation analysis. Although both companies have a history of escalating dividends annually, the current disparity in yields positions Chevron as a more attractive income option. Moreover, this variance hints at Chevron’s superior valuation standing, as illustrated below. This observation naturally steers us towards another pertinent point of contention.

XOM Dividend Yield data by YCharts

Although Exxon boasts a longer streak of 41 years of consecutive dividend hikes compared to Chevron’s respectable 36 years, the latter’s financial robustness shines through. A key pillar supporting their prolonged dividend prowess is their stalwart balance sheets. Essentially, they leverage debt during market downturns to sustain operations and uphold dividend payouts. As oil prices resurge cyclically, these companies trim debt levels in readiness for the next downturn. Presently, Chevron’s lower debt-to-equity ratio of 0.12 versus Exxon’s 0.18 confers it with more financial flexibility and resilience.

XOM Debt to Equity Ratio data by YCharts

While the variance in debt levels isn’t staggering, it signifies Chevron’s edge over Exxon in maneuvering through challenging market conditions. Conservative investors, enticed by a potent mix of robust yields and sturdy financial foundations, are likely to find Chevron a more appealing prospect presently, especially if energy stocks are within their investment radar.

CVX data by YCharts

In the grand scheme of things, however, holding out for an industry slump might prove wise. During such periods, Chevron’s ability to sustain dividends notwithstanding its unwavering historical track record (coupled with a resilient balance sheet) will face rigorous scrutiny. Despite its current allure, those inclined towards bargain hunting may deem this window as missed. Yet, given the cyclical nature of the oil sphere, another opportunity is bound to emerge. The catch, though, lies in mustering the mettle to plunge into investments when the crowd recoils. It’s a daunting prospect but can reap substantial rewards in due course.

A Relative Allure Amidst Absence of Cheapness

Arguably, Chevron doesn’t register as a bargain buy in the existing market landscape. Value-minded investors may have bypassed the optimal entry point this time, particularly missing out on the opportune phase amidst the COVID-induced market turmoil. Nonetheless, Chevron retains its luster when juxtaposed with Exxon, presenting a relatively attractive investment proposition. For those eager to infuse energy exposure into their investment portfolio, Chevron emerges as a resilient contender endowed with a firm fiscal bedrock and a rich legacy of investor gratification. Just bear in mind that while being relatively priced attractively, Chevron doesn’t dwell in the realm of historical cheapness.

Considering an investment of $1,000 in Chevron? Take note:

Before delving into Chevron stocks, ponder this:

The Motley Fool Stock Advisor analysts have unearthed what they deem as the 10 best stocks for investors currently, with Chevron missing the cut. These selected stocks harbor the potential for substantial returns in the foreseeable future.

Stock Advisor furnishes investors with a roadmap to success, featuring insights on portfolio construction, timely updates from analysts, and bimonthly stock recommendations. Since 2002, the Stock Advisor service has surpassed the S&P 500 return thricefold*.

Explore the identified 10 stocks

*Stock Advisor returns as of March 25, 2024

Reuben Gregg Brewer maintains no positions in any of the stocks highlighted. The Motley Fool holds positions in and endorses Chevron. The Motley Fool abides by a transparent disclosure policy.

The opinions articulated here are those of the author and don’t necessarily align with Nasdaq, Inc.’s viewpoints.