“`html

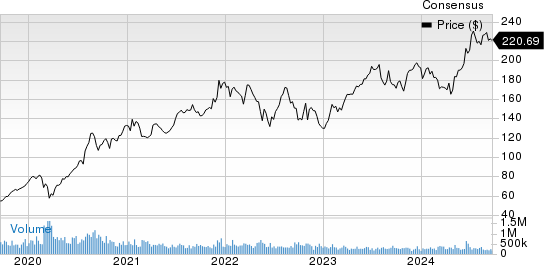

Netflix Reports Strong Q2 Growth and Outlook

Netflix (NASDAQ: NFLX) achieved a revenue growth of 16% year-over-year in Q2 2025, raising its full-year revenue forecast to between $44.8 billion and $45.2 billion. The company’s operating margin increased to 34%, up seven points from the previous year, while free cash flow is projected to reach $8.0 billion to $8.5 billion.

As of May, Netflix’s ad-supported plan has more than 94 million monthly active users worldwide, showcasing a significant increase and contributing to the company’s revenue streams alongside pricing strategies in the U.S. and Canada, which have led to double-digit growth.

Netflix has repurchased approximately $1.6 billion of its stock in Q2, enhancing its investment capital and reflecting management’s confidence in long-term value. The upcoming earnings report on October 21 is expected to confirm growth trends and provide further insights into the company’s strategy.

“`