SBA Communications possesses an extensive and geographically diverse communication real estate portfolio, primed to reap the rewards of wireless carriers’ increased capital spending for network expansion amidst the rapid deployment of 5G networks. Despite embracing portfolio expansion with a sturdy balance sheet, concerns loom large due to notable customer concentration and soaring interest rates.

The Bright Side of SBAC

Evolving mobile technology, including the advent of 4G and 5G networks, alongside the surge in data-heavy applications, has fueled global growth in mobile data usage.

This surge has led wireless service providers and carriers to expand their networks, necessitating additional equipment deployment for existing networks to boost coverage and capacity. Consequently, tower real estate investment trusts like SBA Communications stand poised for growth.

The company sustains a resilient and stable site-leasing business model, primarily deriving revenues from long-term tower leases lasting approximately five to 10 years with built-in rent escalators, ensuring consistent revenues over time.

Moreover, as wireless service providers continue to lease more antenna space on the company’s towers to cater to burgeoning network demands, data transfers, network expansions, and coverage requirements, the growth trajectory of SBA Communications’ site-leasing revenues is likely to remain robust ahead.

SBA Communications strategically expanding its portfolio into select international markets with high-growth prospects places it favorably to capitalize on global trends in mobile data usage and surging wireless spending. In 2023 alone, the company acquired a total of 91 towers and related assets.

Following the year-end of 2023, SBA Communications either purchased or has commitments to buy 281 communication sites for a total cash consideration of $87.8 million. The company anticipates closing these acquisitions by the end of the third quarter of 2024.

On the financial front, SBA Communications concluded the fourth quarter of 2023 with $247.7 million in cash, short-term restricted cash, and short-term investments. As of Feb 28, 2024, the company held $70 million under its $2.0 billion revolving credit facility.

With a projected cash flow growth of 13.13%, significantly outperforming the industry’s estimated negative 4.19%, SBAC appears well-equipped to leverage long-term growth prospects.

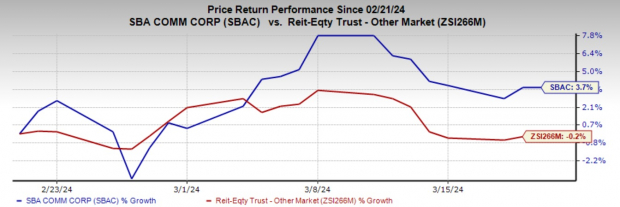

Over the past month, the company’s shares ascended by 3.7%, diverging from the industry’s 0.2% decline.

The Shadows Over SBAC

Despite its strengths, SBAC grapples with high customer concentration, with T-Mobile TMUS, AT&T T, and Verizon VZ constituting the majority of its domestic site-leasing revenues. In 2023, T-Mobile, AT&T, and Verizon represented 40.2%, 28.6%, and 19.7%, respectively, of SBAC’s domestic site-leasing revenues.

Hence, any loss among these crucial clients, consolidation within them, or a reduction in network expenditure may inflict significant blows on the company’s top line. Notably, the churn resulting from Sprint-related decommissioning is anticipated to impose short-term challenges.

SBA Communications shoulders a substantial debt burden, with total debt amounting to $12.4 billion and a net debt-to-annualized adjusted EBITDA leverage of 6.3X by the close of the fourth quarter of 2023. The elevated debt levels are poised to escalate the company’s financial commitments. Moreover, its debt-to-capital ratio exceeds the industry average. Furthermore, operating within a high-interest-rate environment is expected to inflate borrowing costs for the company, directly impacting its capacity to procure or develop real estate.

Market analysts exhibit cautious sentiments toward this Zacks Rank #3 (Hold) corporation, with the consensus estimate for SBAC’s 2024 funds from operations (FFO) per share dipping a cent over the past week to $13.28. The 2025 consensus figure remains stagnant at $13.44.

Note: All references to earnings in this analysis pertain to funds from operations (FFO), a widely utilized metric for evaluating REIT performance.

Explore This Stock For Free >>

AT&T Inc. (T) : Access Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Retrieve Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Obtain Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Access Free Stock Analysis Report

To read this article on Zacks.com click here.

The perspectives expressed here represent the author’s views and do not necessarily align with those of Nasdaq, Inc.