When it comes to investment decisions, the recommendations of Wall Street analysts carry significant weight. They have the power to sway investors towards buying, selling, or holding a particular stock. But are these recommendations truly reliable, and should investors base their decisions solely on them? Let’s unveil the sentiment of analysts regarding Arista Networks (ANET) and evaluate the implications for potential investors.

Wall Street’s Perspective on ANET

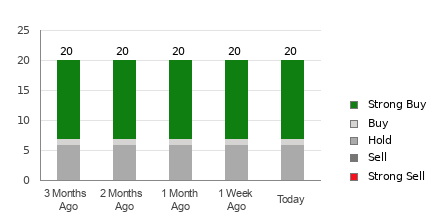

The average brokerage recommendation (ABR) for Arista Networks stands at 1.61, indicating a consensus between Strong Buy and Buy based on the ratings of 22 brokerage firms. Notably, 63.6% of the recommendations are Strong Buy, with an additional 9.1% recommending Buy.

A Deeper Look at Brokerage Recommendations

Despite the encouraging ABR for Arista Networks, it’s imperative not to solely rely on such recommendations. Studies have shown that brokerage recommendations might not consistently lead to favorable stock performance due to the inherent positive bias of analysts towards the companies they cover.

Brokerage analysts often exhibit a strong positive bias, issuing markedly more “Strong Buy” ratings compared to “Strong Sell” ratings. This asymmetric bias could mislead retail investors and fail to provide an accurate reflection of a stock’s potential price movement.

Bridging the Gap: Zacks Rank vs. ABR

Although both Zacks Rank and ABR are presented on a scale of 1 to 5, they represent distinct measures. While ABR relies solely on broker recommendations, Zacks Rank utilizes a quantitative model driven by earnings estimate revisions to evaluate a stock’s potential.

Empirical research has highlighted the significance of earnings estimate revisions, positioning the Zacks Rank as a more reliable tool for predicting near-term stock price movements compared to ABR. Zacks Rank also maintains a timelier and fresher assessment of stocks, making it a valuable resource for investors.

ANET Investment Potential

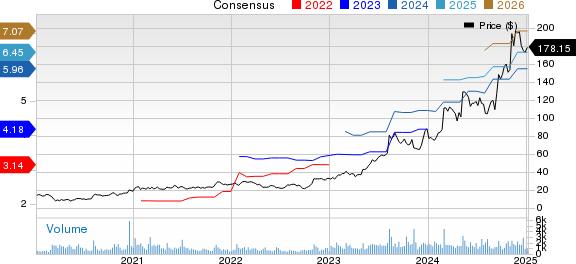

With a 0.3% increase in the Zacks Consensus Estimate for the current year to $6.55, Arista Networks has garnered growing optimism from analysts. This positive consensus has resulted in a Zacks Rank #2 (Buy) for the stock, signaling a favorable outlook for potential investors.

To further enhance your understanding of Arista Networks’ investment potential, you can explore Zacks’ comprehensive list of today’s top-rated stocks.

In light of the compelling analysis, the Buy-equivalent ABR for Arista Networks presents itself as a valuable guiding light for investors.

For readers seeking deeper insights into promising stocks, Zacks offers a bonus report on an AI-focused growth stock that is poised to make a significant impact on the market. Additionally, Zacks provides access to reports on other “must-buy” stocks for investors.

Download Free ChatGPT Stock Report Right Now >>

For those keen on staying updated with the latest stock recommendations from Zacks Investment Research, a report on the “7 Best Stocks for the Next 30 Days” is available for download.

Explore in-depth analysis and the latest news on Arista Networks, Inc. (ANET) on Zacks.com.

Disclaimer: The views and opinions expressed are those of the author and do not necessarily reflect those of Nasdaq, Inc.