When it comes to making investment decisions, Wall Street analysts’ recommendations often carry substantial weight in the eyes of investors. The ups and downs of stock ratings from these brokerage-firm-employed analysts can significantly influence a stock’s price. But are these recommendations truly worth their weight in gold?

Before delving into the reliability of brokerage recommendations and how to leverage them to your advantage, let’s take a peek at the sentiments of Wall Street heavyweights towards Chevron (CVX).

The Numbers Speak: CVX Brokerage Recommendations

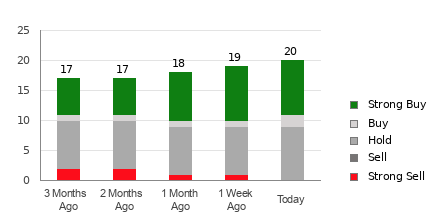

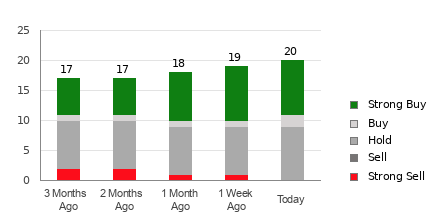

Chevron currently boasts an average brokerage recommendation (ABR) of 1.70, perched on a scale of 1 to 5 (from Strong Buy to Strong Sell). This figure is a result of the actual recommendations (Buy, Hold, Sell, etc.) tendered by 20 brokerage firms. Essentially, an ABR of 1.70 approximates between Strong Buy and Buy on the rating scale.

Of the 20 recommendations pooled to derive the current ABR, 12 scream Strong Buy while two whisper Buy. This means Strong Buy accounts for 60% and Buy for 10% of all recommendations, reflecting a rather bullish stance on the stock’s potential.

Check price target & stock forecast for Chevron here>>>

Parsing the ABR: What Does It Truly Indicate?

The ABR suggests a resounding “Buy” for Chevron, but it’s imperative to exercise caution when using this information as the sole basis for investment decisions. Multiple studies have reasonably argued that brokerage recommendations may not reliably lead investors to stocks with the highest potential for price appreciation.

Why is this the case? Brokerage firms, owing to their vested interest in the stocks they cover, tend to exhibit a strong positive bias when rating them. In essence, for every “Strong Sell” recommendation, these firms can dish out as many as five “Strong Buy” ratings. This inherent bias isn’t always aligned with retail investors’ best interests, often painting an inaccurate picture of a stock’s future trajectory.

That said, the ideal way to wield this information lies in cross-referencing it with your own research or a proven indicator of a stock’s price movement.

The Zacks Rank: A More Trustworthy Indicator?

Perhaps a more robust tool for making investment decisions is the Zacks Rank. With a solid track record externally audited, the Zacks Rank divides stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It serves as a reliable barometer of a stock’s price performance in the immediate future. Hence, using the ABR to validate the Zacks Rank may streamline your investment strategy.

ABR vs. Zacks Rank: What Sets Them Apart?

While both the ABR and Zacks Rank occupy a scale from 1 to 5, they are fundamentally distinct metrics. Broker recommendations exclusively underpin the ABR, often showcased in decimals (e.g., 1.28). On the contrary, the Zacks Rank operates as a quantitative model harnessed from earnings estimate revisions and is exhibited in whole numbers ranging from 1 to 5.

It remains evident that brokerage analysts, being beholden to their employers’ interests, are prone to dishing out more optimistic ratings than their research would genuinely warrant, leading to potential misinformation. In contrast, the Zacks Rank heavily relies on earnings estimate revisions, demonstrating a strong correlation between these revisions and immediate stock price movements.

Timeliness and Earnings: A Critical Analysis

One notable disparity between the ABR and Zacks Rank pertains to timeliness. While the ABR may meander in an outdated state, owing to possible delays in brokerage recommendations, the Zacks Rank remains chronologically poised. This is because brokerage analysts frequently adjust their earnings estimates in response to evolving business trends, thereby ensuring the Zacks Rank’s promptness in predicting future stock prices.

Is Chevron Truly a Buy?

From the perspective of earnings estimate revisions, Chevron’s Zacks Consensus Estimate for the current year has endured a 6.4% decline over the past month, settling at $13.03.

The exciting unanimity among analysts in downwardly revising EPS estimates hints at a potential near-term downtrend for the stock. Consequently, this recent consensus estimate upheaval, combined with other related factors, has plunged Chevron into a Zacks Rank #5 (Strong Sell) territory.

Given these circumstances, it might be wise to take Chevron’s ABR equivalent with a pinch of skepticism.

Zacks Names #1 Semiconductor Stock

Chip stocks are hot right now. Embracing the potential of Artificial Intelligence, Machine Learning, and the Internet of Things, a soaring demand for semiconductors is on the horizon. Explore this top chip stock now.

Want more valuable insights from Zacks Investment Research? Grab an exclusive look at the 7 Best Stocks for the Next 30 Days.

If you’re keen on digging deeper into Chevron’s prospects, you can access the full Free Stock Analysis Report. Furthermore, you can read this article directly on Zacks.com.

*The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.*