Are Analyst Recommendations Really Worth the Hype?

When it comes to making investment decisions, many investors turn to analyst recommendations for guidance. These reports often shape market sentiment, but should they hold as much sway as they do? Let’s delve into the world of brokerage recommendations and see how they intersect with the intriguing case of InMode (INMD).

An Insight into Wall Street’s Sentiment Towards InMode

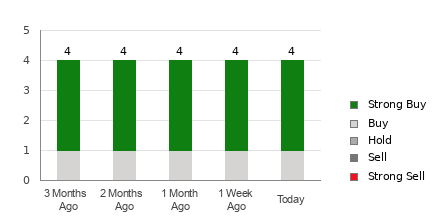

The average brokerage recommendation (ABR) of 2.00 currently sits as a shining beacon for InMode, reflecting a bullish stance. With half of all recommendations being pegged at Strong Buy, the analysts’ optimism casts a rosy hue over the company’s prospects.

Brokerage Recommendations vs. Reality

Despite the glowing ABR for InMode, studies suggest that blindly following these recommendations may not always lead to profitable outcomes. Brokerage firms, with their inherent biases, tend to skew their ratings with a pronounced positive tint. For every “Strong Sell” recommendation, you’re likely to encounter a barrage of “Strong Buy” endorsements.

So, while these ratings may not paint the most accurate picture, they can serve as a supporting pillar for your own research or a reliable predictive tool.

Zacks Rank: The Unbiased Oracle of Stock Analysis

Enter the Zacks Rank – a trustworthy companion in the tumultuous realm of stock analysis. Based on objective metrics like earnings estimate revisions, the Zacks Rank tiers stocks into five distinct categories, providing a clearer lens to perceive a stock’s potential trajectory.

Unlike the ABR, the Zacks Rank steers clear of the biases that plague brokerage recommendations. Instead, it hones in on fundamental indicators like earnings revisions, offering a more grounded perspective.

Deciphering the True Worth of INMD

As we draw the curtain on InMode’s earnings estimate revisions, a murkier picture emerges. With a Zacks Rank #4 (Sell) accompanying a decline in the consensus estimate, the company faces headwinds on the horizon.

While the ABR shines with optimism, it might be prudent to take it with a pinch of skepticism, especially considering the Zacks Rank’s less optimistic outlook.

Just Released: Zacks Top 10 Stocks for 2024

Grab a front-row seat to the top 10 stocks handpicked by Zacks Director of Research, Sheraz Mian. With a track record that speaks volumes, these stocks offer a tantalizing glimpse into a world of potential gains that beckon the discerning investor.

Don’t be left behind – witness these groundbreaking picks before the crowd catches on.

Discover the New Top 10 Stocks

Read the full article on Zacks.com here

Explore Zacks Investment Research

Please note: The opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.